Inflation

The stock market of any country is influenced by various factors that determine its economic development. Inflation is a commonly known factor that has such influence on the equity market. Many studies have revealed that the stock market is a key indicator of the economic development of a country. It is defined as a consistent rise in the price rates within a specific industry or in the entire economy of the state (Makiinen 344). The increase in the interest rates is justifiably considered one of the factors that affect the state economy most negatively. As a result, the Federal Reserve, investors, and businesses conduct constant evaluations of the equity market to monitor the inflation patterns.

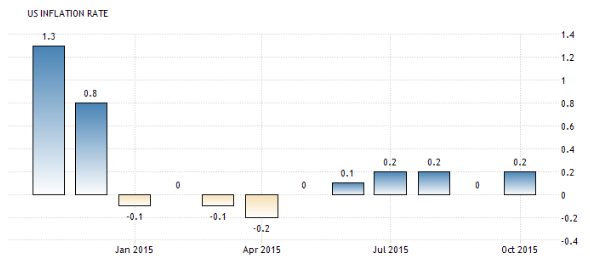

When it comes to defining the effects of inflation on the Saudi stock market, one must mention that the latter shrinks significantly as the inflation rates increase. In October 2015, the rate of inflation in the Saudi stock market stood at 2.4 percent (see figure 1 below). The graph in figure 1 below also reveals that the inflation rate in Saudi remained at an average value of about 2.8% since 2000. On the other hand, the current inflation rate in the United States stock market is -0.09%. Odeon reveals that the US consumer prices increased by about 0.2% in October. This value was seemingly high (15). The US average inflation rate was 3.3% as compared to Saudi’s 2.8% in October.

Similarly, inflation has a range of negative effects on the U.S. stock market, seeing that it makes the key stakeholders lose an impressive amount of revenues.

The chart in figure 3 above shows a recent drop in the Dow Jones Rates. This trend reveals that the inflation rate in the United States is becoming increasingly positive as reflected in the overall economy. Despite the infamous crisis of 2007–2008 that had radical effects on the US equity market, its performance follows a positive trend at present (Makiinen 119).

According to Makinen, inflation only poses negative effects on particular stock markets; hence, it can allow the adjustment of relative prices (Makiinen 36). In this manner, it creates room for providing customers with an opportunity to save by developing a more flexible pricing strategy. Nevertheless, when swinging out of control, inflation poses a significant threat to the wellbeing of the stock market. Hence, the inflation rates should be reduced in the US and UAE so that the corresponding stock markets could function properly.

Deflation

Likewise, deflation can be viewed as a rather negative factor altering the environment of both the US and Saudi Stock markets. According to the existing definition, deflation is typically identified as a reduction in the price rates in the economy of a specific country or the environment of a certain market: “The standard definition of inflation is a protracted period of generalized price increase, which can occur when too much money causes too few products” (Odekon 202). Therefore, it can be assumed that the specified phenomenon triggers a rapid decline in the profit of the target markets. Indeed, a closer look at the recent changes in the U.S. stock market caused by deflation will reveal that the market has suffered a drastic change.

In comparison, the UAE market also experienced a significant drop in its growth rates as the deflation rates peaked in 2010. The specified phenomenon can be attributed to the fact that the organization has been experiencing a significant slowdown in its economic development, in general, and the recuperation of the oil industry, in particular, after the infamous crisis of 2007–2008. As the studies on the subject matter show, the state organizations along with private firms have experienced a significant drop in the stock prices; hence, the necessity to galvanize the state economy by increasing prices for other commodities emerged. Although the UAE economy seems to have evaded the trap of deflation, some of its effects can still challenge the further evolution of the state economy. This trend can trigger undesirable results in the development of the economy. For instance, a recent analysis shows that the deflation issue still echoes in some of the areas of the UAE economy. “According to HSBC UAE Purchasing Managers’ Index, overall input prices continued to increase in the UAE non-oil producing private sector during December. The rate of input price inflation eased and was the lowest since September 2010” (John par. 1).

Recommendations

To address the above-mentioned concern regarding the UAE inflation rates, which seem to have been unreasonably high since the infamous crisis of 2007–2008, the state government will have to introduce certain changes to the oil industry as one of the most profitable ones in the target market. Indeed, the consistent success, which the target industry has seen, is likely to serve as a major boost to the state economy and, therefore, bring the inflation rates down. In addition, the choice of a supply slide policy should be viewed as an opportunity. There is no need to stress that the specified approach is typically viewed as the most common tool for addressing the inflation issue. However, its consistent use does not make it less efficient. It should be borne in mind, though, that the specified tool can require a significant time to take its effect on the state economy and the wellbeing of the U.S. residents, the outcomes of the policy in question still can be deemed as very strong. Therefore, the specified approach deserves to be taken into consideration as the means of managing the inflation rates in the state.

A closer look at the target economies will reveal that the UAE is currently under a threat of facing deflation. Indeed, as a recent analysis of the current economic situation in the state shows, the prices for a range of goods and services have plummeted, thus, leaving several organizations suffering from a lack of income and, thus, facing the threat of an untimely demise (Jones par. 8). The rate of deflation in the UAE poses a threat to its economy. If the process of deflation gets out of hand, the government is likely to face severe issues regarding the rapid demise of a range of small and even medium organizations, particularly sole proprietorships, which are vulnerable to the changes in the currency rates (Jones par. 8).

When addressing the issue of deflation, one should view the adoption of the above-mentioned approach strategy as an opportunity. Although reducing interest rates seems the first-choice solution, it may lead to no effect in situations that include the so-called liquidity trap. Defined as “a liquidity trap is a situation described in Keynesian economics in which injections of cash into the private banking system by a central bank fail to lower interest rates and hence fail to stimulate economic growth” (Feenstra and Taylor 87). The latter is likely to impede the promotion of sufficient spending rates among the US population; consequently, the economic conflict in question may spin out of control.

Conclusion

While the effects of inflation on the US and UAE stock market can be viewed as having a partially two-sided effect on the state economy. One still has to admit that, when spinning out of control, they start posing a serious threat to the financial and economic wellbeing of not only the private and state entrepreneurship but also to the citizens. It is recommended, thus, that the governments of both states should consider the introduction of the tools that will help manage the inflation rates in; particularly, the adoption of the contractionary policy as the most popular tool for addressing the inflation-related issues and the tools for increasing the commercial bank’s revenues should be viewed as the most reasonable options.

Works Cited

Dow Jones Industrial Average 2006-2015 2015. Web.

Freenstra, Rovert and Alan Taylor. International Macroeconomics (Loose Leaf). 2nd ed. London, UK: Worth Publishers, 2013. Print.

John, Isaac. “Dubai Posts Deflation in 2012.” Khalee Times. 2013. Web.

Jones, Harvey. “UAE Investors Ponder the Spectre of Deflation.” The National Business 2015. Web.

Makiinen, Gail. Money, Banking, and Economic Activity. New York City, NY: Academic Press, 2014. Print.

Odekon, Mehmet. Booms and Busts: An Encyclopedia of Economic History from the First Stock Market Crash of 1792 to the Current Global Economic Crisis. New York City, New York: Routledge, 2015. Print.