Al-Mazyunah Free Zone is a free trade zone located in Oman close to the Yemeni border, which makes it well-positioned to serve the markets of Yemen and the Horn of Africa. Despite this location advantage, the zone has an insufficient number of investors from Yemen and especially from the Horn of Africa. Therefore, Al-Mazyunah’s goal is to attract more investors from these countries. This research report provides an analysis of the customer journey of investors of Al-Mazyunah Free Zone and the zone’s marketing strategies and tactics. The central research question of this study is as follows: “Which factors influence the investors’ decisions to establish a company in Al-Mazunah Free Zone?” The purpose of answering this research question is to find the ways in which Al-Mazyunah can attract new investors from Yemen and the Horn of Africa.

The research question was answered using both primary and secondary research. Primary research was of qualitative design and included two interviews with experts, namely, the Marketing Director of Madayn and the Director of the Investment Department of Al-Mazyounah, and seven interviews with Al-Mazunah’s current investors. Secondary research involved a review of the recent literature on the topic of this study and included a variety of credible sources, ranging from academic articles to online documents.

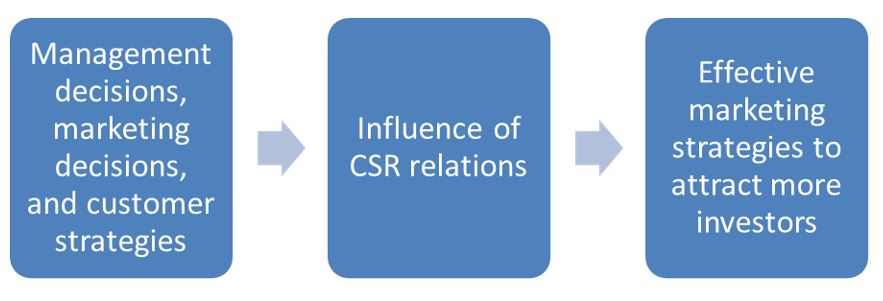

Desk research revealed that investors base their investment decisions on government, marketing, and company management factors. The most significant government factors are a favorable legislative environment, political stability, and the ease of establishing a business in the free zone. Geographic location was also a crucial factor, especially for those investors whose businesses were focused on trade. In addition, good infrastructure was found to be significant for investors, and a lack of it was usually compensated by significant financial incentives. Important marketing factors included the ease of finding the information about the free zone and the availability of information on the Internet.

The findings of the primary research revealed the profile of the current investor of Al-Mazyunah. It was found that a typical investor of Al-Mazyunah is an experienced entrepreneur aware of the subtleties of running a business in the region and able to operate in a dynamic environment. Investors of Al-Mazyunah generally do not depend on seasonality, that is, seasonal shifts of climatic conditions, but invest when there are favorable conditions in the investment location, such as political stability. Al-Mazyunah’s investors’ reasons for investment include the advantageous location of the zone, as well as fiscal incentives and government support.

Primary research also allowed for determining the customer journey of Al-Mazyunah’s investors. The awareness stage is distinguished by investors’ learning about Al-Mazyunah from the dialogue with industry peers and the Internet. The findings showed that investors are not completely satisfied with the quality of Al-Mazyunah’s website. The quality of Al-Mazyunah’s website is also lower than that of its competitors, so Al-Mazyunah should consider improving the layout and the information presented on its website. The engagement phase was characterized by the use of e-mails and phone calls to contact the administration of the zone. The findings also revealed that Al-Mazyunah was not present on social media platforms that could serve as an additional way of engagement. When analyzing the evaluation stage of the customer journey, it was found that investors compared Al-Mazyunah and its competitors in terms of their geographic location, partnerships, access to the necessary resources, and tax regulations. The purchase phase was marked by investors’ decisions to invest in Al-Mazyunah because of its advantageous location and favorable tax regulations, but the poor quality of infrastructure in Al-Mazyunah was mentioned as a shortcoming.

Introduction

Free economic zones are a group of special geographic territories that provide designated economic trade opportunities for businesses with very light or no taxation at all in order to encourage the development of prosperous economic activity. Depending on the country where the free zone is located, the taxation rules are determined differently. The conditions and benefits of free zones are controlled by the principles of the “World Trade Organization,” which also promotes the use of free ports favored through the adoptable customs regulation procedure.

The current research project evaluates the benefits of Al-Mazunah Free Zone, the investment site located in Oman four kilometers away from the Yemen border, overall covering three million square meters. The free zone includes numerous facilities such as shopping and service centers, hotels, showrooms, livestock and multipurpose shopping areas, mosque, as well as both parking and green areas. The free zone also has necessary infrastructural items such as communication channels, roads with integrated traffic controls, bridges, and sustainable mobile network. The investment opportunity envisioned by this zone is the close proximity to Yemen, which allows recruiting its workforce without excessive visas and paperwork procedures. However, it is also considered that a bulk of potential workforce could be attracted from the Horn of Africa, considering the future Al-Mazunah metropolitan development.

The reviewed free zone presents an attractive opportunity for the foreign investors because of the Oman government support. In Al-Mazunah, investors receive an exemption from the income tax for 30 years without the necessity to fill in the tax income return form, as well as get access to an eased procedure of handling foreign currency operations and capital input. Additionally, a residence permit in Oman is guaranteed through the simplified procedure, which is particularly beneficial for the Yemeni citizens. Considerably, the Al-Mazunah provides a fruitful opportunity to develop international business and trade within the scope of current governmental commitments.

While it is reasonable to consider Yemen as an opportunity to wholesale consumer goods, the Horn of Africa is a perfect source of accommodating agricultural supplies, which, in combination, provides a perfect opportunity to develop the supply framework for managing trade partnerships and generate higher sales revenues in a free trade zone. Furthermore, considering that Oman pursues a relaxed policy regarding the employment of Yemeni workforce in a free zone, it is essential to consider innovative investment opportunities to promote Omani market as a trading platform. Hence, the overarching research question for the current project could be formulated as follows:

Which factors influence the investors’ decisions to establish a company in Al-Mazunah Free Zone?

Furthermore, the management question is also formulated as follows:

What particular new marketing choices should be applied by Al-Mazunah Free Zone company to attract $ 5 million in investment from Yemen and $ 10 million in investment from Djibouti, Eritrea, Ethiopia, and Somalia in 2021?

The sub-questions considered for the research have been formulated as follows:

- What does previous research say about management and marketing factors critical to optimizing the ways of attracting investors in Free Zones?

- Who are the competitors and what channels do they use to attract investors?

- Which marketing tactics and strategies are used by Al-Mazyunah Free Zone to attract investors?

- What is the persona of current investors of Al-Mazyunah free Zone?

- What is the customer journey of Al-Mazyunah free Zone Investors?

Research Design

The research was performed using a combination of primary and secondary research methods. For the primary research, the qualitative approach of using semi-structured interviews was utilized. The initial purpose was to investigate respondents’ opinions related to the viability of making certain investments in the Al-Mazunah Free Zone based on the specific trade channels such as car showrooms, stores, small scale industries, oil and gas zone, factories and workshops, and miscellaneous and common services. The secondary purpose was to analyze whether the investors from the Horn of Africa are capable of making investments into the chosen area based on the anticipated financial capabilities. The secondary research included the review of the recent literature related to the investment attraction activities in free zones, as well as a brief analysis of Al-Mazyunah’s competitors and their marketing strategies. The summary of methods applied to the specific sub-questions is shown in Table 2.1.

Table 2.1. Research methods used to answer research sub-questions.

The first sub-question required the analysis of the extant literature about government, management, and marketing factors influencing the process of attracting investors to free zones. This question was addressed through the use of secondary research. A literature review was conducted, and the reviewed sources included academic papers and reputable online sources published within the past 5 years and related to marketing strategies used by free zones for investment attraction.

The second sub-question focused on the analysis of the competitive landscape and, therefore, was explored through the use of secondary research. The secondary sources included publications that described the business activities and marketing channels of Al-Mazyunah’s local and international competitors. In addition, the competitors’ online promotional materials were reviewed to identify the investment benefits that the competing free zones used to attract investors. The idea behind this secondary research was to understand how competitive Al-Mazyunah was compared to its rivals and what marketing strategies it could adopt to improve its competitiveness.

The third sub-question was how Al-Mazyunah Free Zone currently uses marketing strategies and tactics to attract investors. In order to fulfill the research objectives, a combination of both primary and secondary research was utilized. Primary research methods involved conducting interviews with local executives, namely, the Marketing Director of Madayn and the Director of the Investment Department of Al-Mazyounah. The interviewees were selected based on their engagement in the zone’s investment activities and sufficient knowledge and expertise in this area. In particular, the Director of the Investment Department of Al-Mazyounah was chosen as an interview subject because of his experience in interacting with the zone’s investors. The Marketing Director of Madayn was interviewed because Madayn manages Al-Mazyounah Free Zone and promotes its investment opportunities.

Secondary research included exploring Al-Mazyounah’s online marketing materials and the information on two relevant websites. The first reviewed website was Al-Mazyounah’s website, located at www.almazunah.com. It was researched because it was the initial source of information for investors looking for Al-Mazyounah’s investment opportunities online. It appears at the top of the search results, so it was assumed that investors would not miss an opportunity to visit it. The second website was Madayn’s website, in particular, the section devoted to Al-Mazyounah. It was decided to review the information about Al-Mazyounah on Madayn’s website after it was discovered that Al-Mazyounah’s website was not updated since 2013 and marketing activities for promoting Al-Mazyounah’s investment opportunities were done by Madayn.

The fourth sub-question required to analyze the persona of potential investors, and, therefore, was addressed through the application of primary research. Primary research involved semi-structured interviews, during which current Al-Mazyunah’s investors were asked to describe their investment experiences. The interviews were developed so as to create the profile of Al-Mazyunah’s current investor according to Ferrel’s 6W model. In particular, the interviews contained questions to investigate who Al-Mazyunah’s investors were, when they invested, and why they invested in Al-Mazyunah.

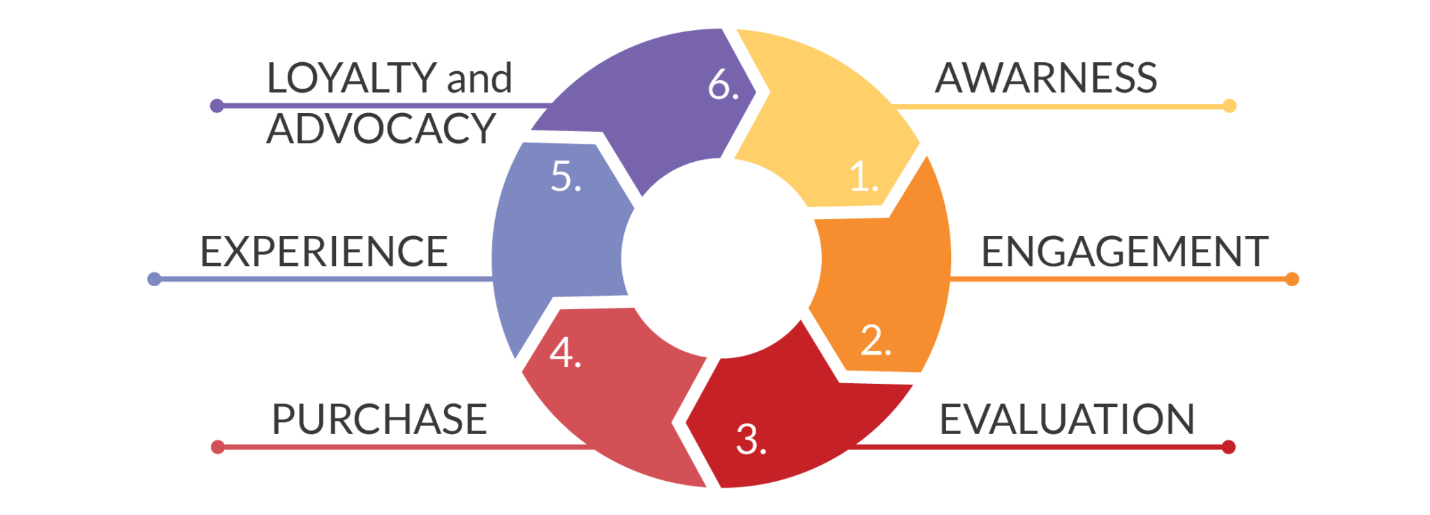

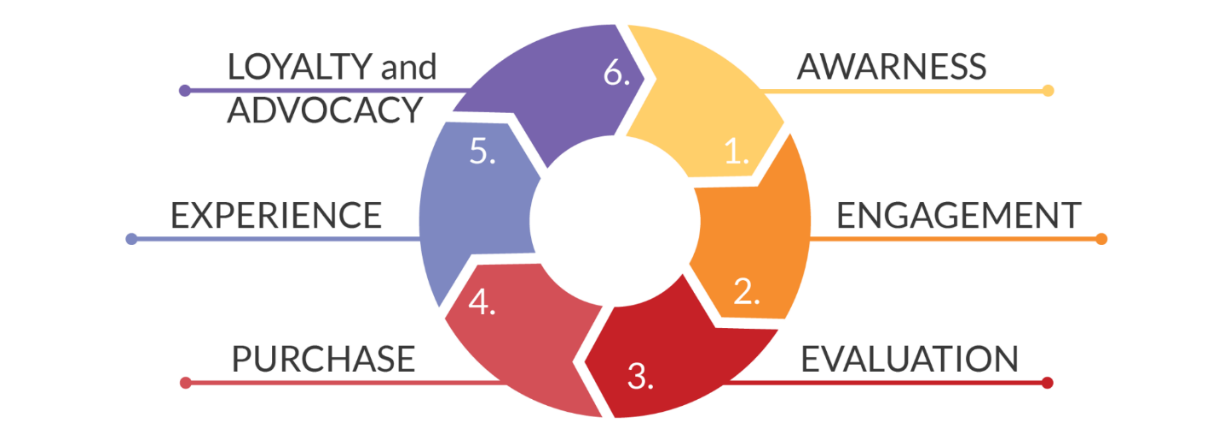

The fifth sub-question focused on the analysis of the customer journey. To investigate the customer journey of Al-Mazyunah’s investors, primary research methods consisting of semi-structured interviews with current investors were used. Interview questions were based on the theoretical model of customer journey consisting of the following stages: awareness, engagement, evaluation, purchase, experience, and loyalty and advocacy (Scucchi, 2019). Since the research focused on studying factors that encourage investors to invest in Al-Mazyunah, the emphasis in the interviews was put on exploring the first four stages.

The present study used two qualitative research methods, namely, in-depth interviews and secondary data analysis. The secondary sources were different for each of the sub-questions and have already been discussed in the respective sections above. In-depth interviews were divided into two subsets: interviews with experts and interviews with current investors (see Appendix B for transcripts). In both cases, the interviews were semi-structured, which means that the questions were prepared beforehand, but the researcher reserved the right to ask clarifying questions when the answers given by the respondents seemed unclear or irrelevant.

The interviews with experts, i.e., the Marketing Director of Madayn and the Director of the Investment Department of Al-Mazyounah, were conducted via the telephone, recorded, and transcribed afterward. For investors’ interviews, it was decided that 7 respondents would be enough to meet the objectives of the study, that is, to create Al-Mazyounah’s investor profile and investigate investors’ customer journey. Of the seven interviews, three were conducted via face-to-face communication, and four were conducted via video calls. Due to time constraints, all the interviews were limited to an average of 30 minutes.

Differences from the Initial Proposal

This section will identify the differences between the initial research proposal and the actual study. The reasons for changes in research design will also be provided. The discrepancies between the research proposal and the carried out research include a lack of investors from the Horn of Africa, the absence of investors from small scale industries, only three face-to-face interviews, and no need for a survey of investors.

Only One Investor from the Horn of Africa

The initial research proposal was aimed to conduct interviews with investors from Yemen and the four countries of the Horn of Africa, i.e., Djibouti, Eritrea, Ethiopia, and Somalia. However, the researcher managed to find only one investor from the Horn of Africa, namely, from Somalia. As a result, interviews were conducted with one Somalian investor and six Yemeni investors.

No Investors from Small Scale Industries

Since Al-Mazyunah has seven different zones, the researcher planned to conduct interviews with investors from several of these zones. Initially, it was expected that 7 investors for interviews would be selected as follows:

- Car showrooms (2 Interviews)

- Store (2 Interviews)

- Small scale industries (1 Interview)

- Oil and gas zone

- Factory and workshops (2 Interview)

- Miscellaneous services

- Services

However, the researcher did not manage to find any investors from small scale industries. As a result, one interview that should have been conducted with an investor from small scale industries was replaced with an interview with an investor involved in the store business. Thus, the actual selection of investors for interviews was as follows: 2 investors from car showroom business, 3 investors from the store business, and 2 investors from factory and workshop business.

Only Three Face-to-Face Interviews

Initially, it was planned that all interviews with experts and investors should be conducted face-to-face. However, due to the COVID-19 pandemic and subsequent social distancing, the researcher managed to conduct only three face-to-face interviews. The other four interviews with investors were conducted via video calls, and the interviews with experts were conducted via the telephone.

No Investor Survey was Needed

The initial research proposal suggested that the information about the marketing channels that attracted investors (sub-question 3.3) and investors’ ways of engagement with Al-Mazyunah (sub-question 5.2) should be assessed with the help of an online survey with predefined answers. However, during the actual research, it turned out that this information could be retrieved during the interviews with investors. Therefore, the researcher included the questions about how investors learned about and engaged with Al-Mazyunah in the interviews with investors. It made the use of an online survey redundant, so the survey was not conducted.

Reliability and Validity

The present study implemented the qualitative research design to meet the research objectives. In qualitative research, reliability means that the researcher uses approaches that are consistent and stable (Creswell & Creswell, 2018). The reliability of this study was ensured by developing and documenting each step of the research. The questions to all interviews were developed beforehand and were meant to investigate specific themes (see Table 2.2).

Table 2.2. Themes explored in the interviews with experts and investors.

All interviews were recorded with respondents’ permission and transcribed. The researcher also took handwritten notes during the interviews to make sure that the information would be kept if the audio recording equipment failed. For the data analysis, the researchers used interview transcripts. For the convenience of the analysis of investors’ responses, they were organized in tables according to the discussed themes.

In qualitative studies, validity means that the researcher checks whether the findings of the study are accurate (Creswell & Creswell, 2018). To ensure the validity of the study, that is, the accuracy of findings, several measures were undertaken. First, the researcher determined the required number of respondents – 2 experts and 7 investors – to support the research with multiple sources of primary data and find common themes in interviewees’ responses. The interviewed investors constitute a homogenous group since all of them come from the Middle East region and are current investors of Al-Mazyunah. Therefore, the choice of respondents is considered valid for the present research. Second, Creswell & Creswell (2018) argue that a rich description of the research process contributes to the qualitative research validity. Therefore, the researcher described the research design in elaborate detail in the respective chapter (chapter 2).

Limitations

The present study has several limitations. First, although the sample size of seven respondents was sufficient for the purpose of the research, the choice of respondents appeared to be different from the initial proposal. Instead of the planned four respondents from four countries of the Horn of Africa, the researcher found only one investor from Somalia. Therefore, the other six respondents were recruited from the Yemeni investors. As a result, one should take caution when generalizing the results of this study to all investors from the Horn of Africa. Second, the study has limitations pertaining to self-reported data since primary data was collected with the help of in-depth interviews. However, since the interview questions were designed to retrieve factual data rather than investors’ subjective experiences, there is a low possibility that the respondents’ answers were biased.

Context and Literature

This chapter aims to explore the context of the study and the relevant literature related to the research question. The context section will provide an overview of Al-Mazyunah Free Zone, which is the object of the present study. The literature section will summarize the extant research about free economic zones and investment attraction in free zones. The purpose of this chapter is to put the case of Al-Mazyunah in a broader concept and demonstrate the importance of the present study.

Context

This section will describe Al-Mazyunah Free Zone in relation to the research problem of attracting more investors from Yemen and the Horn of Africa. The mission and vision of the free zone will also be stated to provide an understanding of the zone’s business strategy. Finally, the target goals of Al-Mazyunah will be outlined.

Al-Mazyunah Free Zone

Al-Mazyunah is a free trade zone located in the governorate of Dhofar in the southern part of Oman. It was established in 1999 and was the first free zone created in Oman. Apart from being situated in the Gulf region, the geographic location of Al-Mazyunah is distinguished by the zone’s closeness to the Yemeni border. The zone is strategically positioned for transit trading with Yemen and East African countries. For this reason, investors from Yemen and the Horn of Africa are the most desirable group of customers for Al-Mazyunah.

Al-Mazyunah is affiliated to Madayn, also known as the Public Establishment for Industrial States, which manages and operates Al-Mazyunah, the “Knowledge Oasis Muscat,” and seven industrial cities. In addition, the lease of Al-Mazyunah is operated by Golden Hala Company. Investors in Al-Mazyunah are involved in a variety of industries in the commercial, industrial, and service sectors. In 2020, the number of companies investing in Al-Mazunah reached 240, with 90 of them being under construction (Oman Daily Observer, 2020). The free zone also witnessed significant economic growth in the first half of 2020. By the end of June, the total value of goods incoming in the zone was over 330 million Omani riyals compared to 143 million at the same period in 2019 (Oman News Agency, 2020). The volume of incoming goods and the number of incoming vehicles also considerably increased in 2020 compared to 2019 (Oman News Agency, 2020). The growth can be attributed to Al-Mazyunah’s facilities and the incentives offered to investors by the government.

In Al-Mazyunah, continuous improvements are made to make the free zone more attractive for investors. For example, currently, the zone is working on projects related to broadband and electricity transmission to the leased firms (Oman Daily Observer, 2020). Furthermore, in 2020, Madayn eliminated several storage and entry fees in Al-Mazyunah (Oman News Agency, 2020). It was done with the purpose of overcoming the consequences of the COVID-19 lockdown and attracting new local and foreign investors. The free zone also signs agreements with different firms to provide its investors with a better customer experience. For example, in 2020, Al-Mazyunah signed an agreement with “Al Madina Logistics Services,” which would increase the efficiency of logistics operations, such as the management of unloading and loading of cargoes at the dry port (Oman News Agency, 2020). Thus, Al-Mazyunah makes constant efforts to boost its attractiveness as an investment location.

The reason behind Al-Mazyunah’s pursuit of attracting more investors is that investments lead to multiple economic benefits. First, Al-Mazyunah Free Zone, along with other Omani free zones, contributes to the economic growth and development of Oman. In particular, free zones increase the volume of Omani imports and foster the development of its infrastructure, particularly the transport network. Furthermore, free zones create new job opportunities for local cadres. Al-Mazyunah and other Omani free zones also help Oman to diversify its economy by providing investors with an opportunity to establish companies not only in the oil and gas industry but also in other industries (Crowe, 2020). Hence, Al-Mazyunah is motivated to attract more investment not only for its own economic growth but also for strengthening the national economy.

Mission and Vision of Al-Mazyunah

Like any business entity aimed at strategic development, Al-Mazyunah has its vision and mission. The zone’s vision statement is a “free commercial zone participating in increasing the regional competition of Oman concerning attracting and developing the local and international investment” (The City of Free Trade, n.d., p. 5). Its mission is to build and equip a free commercial zone that is a center of national and foreign investments (The City of Free Trade, n.d.). Al-Mazyunah aims at attracting investments by providing the best services, effectively managing its operations, and partnering with authorities at local and international levels.

Target Goals of Al-Mazyunah

Al-Mazyunah is well-positioned to meet the needs of investors willing to reach the Yemeni and East African markets. In addition, the free zone offers attractive incentives and investment opportunities. Given the free zone’s valuable offering and its intention to attract new investors, it is assumed that the zone needs to improve its marketing strategies and tactics to reach and attract its potential customers.

It was decided that Al-Mazyunah’s goal should be the attraction of investors from Yemen and the Horn of Africa. The reason for this choice is that Yemen can serve as an excellent market for consumer goods, especially given the simplified customs relationships between Oman and Yemen, while the countries of the Horn of Africa can be valuable trading partners in agricultural sales. The target goal for Al-Mazyunah would be a $5 million investment from Yemen and a $10 million investment from Djibouti, Eritrea, Ethiopia, and Somalia in 2021. The present research aims at finding out what new marketing techniques could be used by Al-Mazyunah to attract investors from Yemen and the Horn of Africa in order to meet the stated target goal.

Literature

This section will provide an overview of literature related to free zones and foreign direct investment in free zones. It will help to get a better understanding of the business of Al-Mazyunah and its goal to attract more investors. The first sub-section will discuss what free economic zones are, why they are established, and how they can operate effectively. The second sub-section will define foreign direct investment and explain why free zones need it and what steps they should take to attract investment.

Free Zones

Governors have been offering preferential treatment to traders since ancient times by establishing free zones, in which traders and investors were free from regular import and export duties and regulations. In exchange, traders provided the governments with a continuous stream of goods, which was an essential condition for economic growth and development. According to Demyanova et al. (2018), the first free zones were established in the Mediterranean region in the second century BC. Since then, free zones have emerged in different parts of the world and evolved into complex structures with strong governmental support consisting of various benefits and incentives for investors.

There are four types of free zones: free trade zones, export processing zones, special economic zones, and industrial zones. Free trade zones are usually located near airports or seaports and offer customs duty exemptions on goods that are re-exported (McLoughlin, 2020). While free trade zones add little value to re-exported goods, export processing zones specialize in exports with considerable value added to the traded goods (McLoughlin, 2020). Special economic zones serve not only foreign but also domestic markets and provide incentives, such as infrastructure, customs and tax exemptions, and facilitated administrative procedures (McLoughlin, 2020). Industrial zones specialize in a particular industry, e.g., textiles, and are equipped with all the facilities necessary for that industry (McLoughlin, 2020). Al-Mazyunah classifies itself as a free trade zone, which implies that its activities are mainly focused on re-exports. However, the zone also provides incentives, including tax and customs exemptions and simplified administrative procedures.

In order to foster trade and attract investors, free zones offer a range of incentives. These incentives may include exemptions from customs duties and tariffs, fiscal incentives, favorable regulations concerned with land access and employment, and facilitation of administrative procedures (UNCTAD, 2019). Another incentive is good infrastructure, which is especially important in developing countries where infrastructure outside of free zones may be poor (UNCTAD, 2019). McLoughlin (2020) also cites added security as a benefit provided to investors by free zones since these zones are often surrounded by a perimeter fence. An exemption from restrictions on foreign ownership is also a common incentive in free zones.

The reasons for establishing free zones may differ depending on the level of development of the country in which they are created. According to UNCTAD (2019), developed countries usually establish free zones to facilitate trade logistics, while developing economies aim at industrial development. In high-income countries, free zones serve only as logistics hubs and science parks, the purpose of which is to foster innovation and provide a platform for transborder supply chains (UNCTAD, 2019). Upper-middle-income economies create free zones focused on technology and services, which are aimed at helping the country to transit to a services economy and develop new high-tech industries (UNCTAD, 2019). In middle-income economies, free zones specialized in global value chain industries (e.g., electronics or the automotive industry) and services are established to support industrial development and technology dissemination (UNCTAD, 2019). Finally, low-income economies create multi-activity and resource-based free zones focused on attracting processing industries (UNCTAD, 2019). Free zones in low-income countries aim at stimulating industrial development and diversification, as well as improving the investment climate and concentrating investment infrastructure on a limited area.

Free zones bring multiple benefits to the economies in which they are established. For example, free zones are considered to be an effective tool for stimulating investment inflows (Demyanova et al., 2018). Incentives offered by free zones are supposed to offset infrastructure weaknesses in developing economies and, thus, attract investors (UNCTAD, 2019). Free zones also stimulate and diversify exports and help developing economies to participate in global value chains, i.e., the international fragmentation of production (Demyanova et al., 2018; UNCTAD, 2019). Another positive effect of free zones is their contribution to job creation and employment growth (Demyanova et al., 2018; UNCTAD, 2019). Demyanova et al. (2018) also point out such benefits as an increase in the GDP per capita in the region, an increase in the competitiveness of national industries, the improvement of the skills of the labor force and management staff, and an overall economic and social development. Thus, free zones are entities that have a high potential to improve the industrial and economic development in a particular region.

Although free zones are a useful tool for economic development, they will operate effectively only if they are properly developed and managed. First, free zones should be built on their existing capabilities and competitive advantages (UNCTAD, 2019). If a zone wants to attract high-tech investors but lacks the highly-skilled labor force and the infrastructure necessary for such an industry, it is unlikely to succeed. Therefore, at the initial stage of the zone’s development, it is crucial to determine the proper location with access to the required infrastructure or workforce. Second, the zone’s development plan should be economically feasible to avoid a situation when the zones’ costs exceed benefits (UNCTAD, 2019). Third, free zones should foster the collaboration of firms established on their territory. When companies in a free zone share common services or engage in common training programs, it improves the performance of the zone (UNCTAD, 2019). Finally, free zones should have a solid and transparent regulatory framework, with clearly defined autonomous governing bodies (UNCTAD, 2019). Thus, free zones will be successful if they are established in an advantageous location, base their activities on their capabilities and competitive advantages, and have economically feasible development plans and solid regulatory framework.

Foreign Direct Investment Attraction

Foreign direct investment is an investment made by a company located in one country in a business situated in another country. A distinctive feature of foreign direct investment, which distinguishes it from foreign portfolio investment, is that investors have direct control over the business in another country. Sometimes, foreign direct investment may include not only a capital investment but also the investment of technology and management.

Free zones seek foreign direct investment because it is the primary purpose of their establishment. They serve as a means of motivating investors to invest in the country in which they are created. Investment attraction is necessary to gain the benefits of free zones that were outlined in the previous section. These benefits include increasing exports, the growth of employment, and overall economic development, among others. Frequently, a country builds several free zones to boost its attractiveness for investors. For example, in Oman, Al-Mazyunah is not the only free zone; there are also Salalah, Sohar, and Duqm free zones, as well as several industrial cities. It leads to internal competition, which forces the competing free zones to improve continuously and make active marketing efforts to distinguish themselves from their rivals.

There are four main stages of investment promotion in free zones: investment facilitation, lead generation, strategy and organization, and post-investment services (Loewendahl, 2018). These four stages suggest that investment promotion is not limited to introducing investors to existing investment opportunities and getting investors to set up a business in a free zone. On the contrary, investment promotion is a continuous process that goes on even after investors have become the tenants of the free zone. Further, each stage of investment promotion will be reviewed in more detail.

The first step of investment attraction is investment facilitation. It includes such activities as competitive positioning, image building, creating awareness, and investment prospecting (Loewendahl, 2018). Creating a distinctive image of the zone, developing its clear offer, and raising awareness are essential measures at this stage because investors often make investment decisions based on the available information and an understanding of the zone’s value proposition (Loewendahl, 2018). Van Den Berghe (2018) also states that, at this stage, the zones develop their marketing and promotional materials. Thus, the first step of investment promotion is determining what the free zone has to offer to investors and informing potential investors of the existing investment opportunities.

The second stage of investment promotion is lead generation. Van Den Berghe (2018) suggests that, at his phase, free zones should understand and identify their investment opportunities, as well as identify and target their investors. For these purposes, free zones can use websites and social media, country profiles and sector profiles, and investment opportunity booklets (Van Den Berghe, 2018). They can also make sure that the information about their investment opportunities is included in public and paid databases (Van Den Berghe, 2018). In addition, a Customer Relationship Management system may be helpful for free zones aiming to manage interactions with their potential investors.

At the third stage, investment promotion agencies (IPAs) are involved in strategy and organization, while free zones focus on investor servicing and facilitation. At this phase, IPAs are responsible for setting national policy context and objectives, as well as developing sector and marketing strategies (Loewendahl, 2018). While IPAs aim at promoting investment opportunities in the whole country, which can have several free zones, each of the free zones has to focus on attracting investors to their own investment opportunities. To do so, a free zone should provide effective investor services and develop training for the zone’s staff (Van Den Berghe, 2018). It is also important that the marketing efforts made by IPAs and by free zones were aligned with each other.

The fourth stage of investment promotion is post-investment services or aftercare. Successful free zones support their investors after investment by providing effective aftercare services aimed at retaining investors and encouraging them to reinvest (Van Den Berghe, 2018). Free zones’ staff training should continue at this stage to ensure that investors receive high-quality services (Van Den Berghe, 2018). Investment promotion activities should be monitored and evaluated to identify areas of improvement (Loewendahl, 2018). In addition, free zones should develop channels for policy advocacy (Van Den Berghe, 2018). Thus, free zones should care not only about attracting new investors but also about retaining existing ones and monitor the zone’s activities in search of possible improvements.

The following chapter will review in detail what factors influence investors’ decision to invest in free zones and what marketing approaches are used to attract investors.

Ways of Attracting Investors to Free Zones

The purpose of the present study is to develop an understanding of how Al-Mazunah Free Zone can attract foreign investments from Yemen and 4 countries of the Horn of Africa – Djibouti, Eritrea, Ethiopia, and Somalia – to foster its economic development. To answer this research question, it is necessary to review the extant literature on marketing and management factors that are critical to optimizing ways of attracting investors to free zones. This section will explore marketing approaches used for attracting investors to free zones, as well as government factors and the company’s management and leadership factors influencing investors’ decisions.

Marketing Approaches to Attracting Investors to Free Zones

Investment promotion in free zones requires the use of specific marketing methods. According to Van Den Berghe (2020), since free zones are part of a country, they depend on the competitiveness of their country. It means that investors may be aware of the country but may not know that the country has a free zone with valuable investment opportunities. For this reason, one best marketing strategy to attract investors is to make sure that stakeholders involved in the country promotion are aware of the free zone and include it in their marketing plans (Van Den Berghe, 2020). Collaborating with investment promotion agencies (IPAs) to raise awareness about free zones and encouraging organizations to share information about the prospects whose projects are suitable for free zones are examples of implementing this strategy (Van Den Berghe, 2020). In addition, free zones are often positioned as distinct from the country in which they are located, which helps them to successfully compete with other free zones within the country and emphasize better infrastructure than that available in the rest of the country (Papadopoulos et al., 2016). In their promotional activities, free zones tend to state the benefits of their location, including their potential to provide connections to neighboring economies (Papadopoulos et al., 2016).

Investors should clearly understand the offer of a free zone seeking their investments. To communicate their offer to investors, free zones use a variety of marketing approaches and channels. Van Den Berghe (2020) emphasizes the need for free zones to establish a distinctive brand, which should include a logo and other attributes. Loewendahl (2018) stresses the importance of choosing the right marketing channels for sharing information about investment opportunities. The leading sources of information for investors appear to be a dialogue with industry peers, business travel, newspaper and magazine articles, and meetings with IPAs (Loewendahl, 2018). Although the first two sources can hardly be influenced by marketers, the other two sources should be effectively used in investment promotion activities.

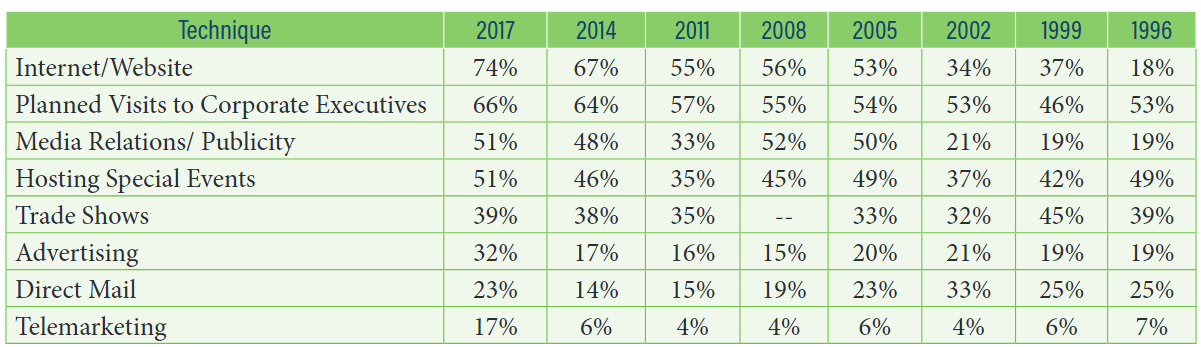

Table 1 also shows marketing techniques that turned out to be the most effective in attracting investors. The Internet is the most effective marketing technique because it allows for information sharing with investors without any time and space constraints (Khairil, 2017). However, for the Internet to be truly effective in marketing, it should align with the entire marketing strategy, and the information on free zones’ websites should be continuously updated to show there is progress in the industry (Khairil, 2017).

The way free zones formulate their marketing messages also has significance. According to Khairil (2017), marketing messages should be focused not only on regional excellence but also on the infrastructure capacity, human resources capacity, and technological advances to provide more value to investors. In print advertising, such features as the sentence and word structure, colors, font, layout design, and paper type can have an additional influence on investors’ decisions (Khairil, 2017). Furthermore, when a free zone uses marketing techniques involving a speaker, the personality of a speaker plays a critical role. Khairil (2017) argues that a speaker with excellent appearance and rhetoric but without an influential government position will not be perceived by investors as credible. Therefore, in public relations, free zones should use speakers who have an influential position in the government.

Raising brand awareness and building a strong brand image is important for investment promotion in free zones. However, it is also critical how rapidly the information about investment opportunities in free zones is communicated. IPAs, which are usually responsible for dealing with investors, should handle investors’ queries within 1-2 days (Loewendahl, 2018). This is the period of processing queries accepted in the private sector, so investors interested in investing in free zones expect the necessary information to be provided to them within this period.

Marketing approaches to attracting investors to free zones have to respond to changes caused by rapidly developing technologies. In this regard, Van Den Berghe (2020) suggests seven winning strategies that are supposed to help free zones cope with emerging challenges.

- The first strategy is focused on leadership and training.

Leadership and training are essential components of any successful business. Van Den Berghe (2020) argues that it is critical for free zones to conduct self-assessment to identify the most necessary skills, then prioritize five of them, and invite experts possessing these skills. In addition, free zones should provide their staff with access to training programs by partnering with various educational institutions (Van Den Berghe, 2020). These measures will ensure that the free zone is adapting to the new industrial environment. Zona Franca Santander in Colombia has adopted this approach, and now it has a large pool of talented and professional workers to offer to its investors (Van Den Berghe, 2020). - The second strategy – research and advocacy.

It is aimed at finding out more about potential investors and their motives for investing in free zones. Van Den Berghe (2020) argues that financial incentives are not the main determinant of investors’ decisions, so free zones should research investors’ needs and tailor targeted offerings. For example, Dubai Multi Commodities Center has used this strategy by transitioning to paperless online services, thus facilitating the process of running a business in the free zone, which has become its additional competitive advantage (Van Den Berghe, 2020). - The third strategy is the future FZ strategy.

This strategy means that free zones should be future-oriented in their activities. Van Den Berghe (2020) suggests that free zones should analyze trends in innovation and sustainability and follow them in their strategy. Identifying top technologies with the potential of influencing the free zone’s industry is an important step while implementing this strategy. - The fourth strategy is related to awareness, marketing, and promotion.

According to Van Den Berghe (2020), free zones should raise awareness about available investment opportunities among various stakeholders and make sure that all agencies involved in investment promotion use a unified marketing and promotion strategy. - The fifth strategy refers to stakeholder engagement.

Stakeholder engagement is important because an increasing number of free zones has made attracting investors a difficult task requiring coordinated teamwork. Van Den Berghe (2020) suggests that the marketing strategy of the free zone should be integrated into the economic strategy of the whole country. Therefore, the involvement of multiple stakeholders is necessary to achieve the strategy’s effectiveness. - The sixth strategy is knowledge management and aftercare.

Free zones should not regard their investors as mere tenants; instead, they should provide investors with aftercare services to foster their growth and development because investors’ success contributes to the success of the free zone. Aftercare services may include rapid service delivery, automation of services, and other activities that improve investors’ experiences. - The seventh strategy is business intelligence and performance.

According to Van Den Berghe (2020), one of the primary investors’ motivations to invest in free zones is the ease of starting a business. Therefore, establishing one-stop-shop services to facilitate the process of investment is an essential measure for attracting investors. Additionally, free zones should measure their performance each month or quarter and define metrics that have the most influence on their success.

Government Factors Critical to Attracting Investors to Free Zones

Since the government is responsible for creating free zones, it has the authority to provide various incentives to investors to influence their investment decisions. According to Condron (n.d.), the government factors critical to attracting investors to free zones include political stability, government support, and legal protection. Government support may include facilitating the process of licensing, adopting incentive policies, and imposing penalties on infringers (Khairil, 2017). Furthermore, the availability of a skilled labor force, suitable infrastructure, and linkages with different industries and educational institutions are also essential (Condron, n.d.).

Finally, investors expect to get assistance from IPAs or equivalent organizations in their day-to-day activities (Condron, n.d.). It is a good practice for IPAs to provide “one-stop-shop” services, accompanying investors at every step of their investor journey, from the decision-making to the after-care stage (Loewendahl, 2018; Van Den Berghe, 2020). Thus, the extent to which the government is willing to support investors is a crucial factor influencing investors’ decisions.

Particular attention should be given to various financial incentives provided to investors in free zones. According to the Organisation for Economic Co-operation and Development (OECD; 2017), such incentives are commonly used in developing countries. The reason for this is that it is easier to decrease costs for investors rather than makes structural changes, such as improving infrastructure or increasing the number of the skilled labor force (OECD, 2017). One way the government promotes investment in free zones is by offering tax incentives to investors.

Jasiniak and Koziński (2017) found out that tax incentives are important for attracting investors; however, their importance depended on the area, company size, and tax incentive types. Researchers discovered that in less economically developed locations, considerable tax incentives were very significant for investors because they compensated for the challenging business environment (Jasiniak and Koziński, 2017). In addition, small companies considering investment opportunities pay more attention to tax incentives than large companies because they are less resistant to challenges (Jasiniak and Koziński, 2017). Overall, investors are attracted to locations that offer lower costs of conducting business.

While financial incentives are a common way of attracting investors, OECD (2017) argues that they may benefit the investing country more than the host country. According to OECD (2017), evidence shows that such government measures as improving infrastructure, removing regulatory barriers, developing human capital, and releasing public information about investment opportunities are more effective in attracting investors to free zones. Governments should make information easily available to investors because if the information is hard to find, investors rely on private sources when making investment decisions.

The influence of the company’s management and Leadership on investors’ decisions

The management and leadership of organizations of free zones also play a vital role in investment promotion. To increase the chance of attracting investors, organizational management should incorporate efficiency, inclusivity, and sustainability (Condron, n.d.). Efficiency means that organizations in free zones should use the best practices, adapting them to their environment (Condron, n.d.). Inclusivity implies partnering with primary and secondary stakeholders, such as industry partners, investors, sponsoring government agencies, IPAs, free zones board, etc. (Condron, n.d.).

While partnerships with stakeholders are important, organizational management should avoid including all stakeholders in the board. Instead, it should maintain the board’s efficiency by appointing a limited number of directors having skills and expertise in the appropriate field (Condron, n.d.). Finally, sustainability in organizational management refers to using information and communication technology in commercial activities, possessing strong functional skills, such as financial and asset management, and having robust funding sources (Condron, n.d.). Thus, to attract investors, the management of organizations in free zones should be qualified to conduct the business in the selected field, apply best practices, and have a strong financial basis.

While management factors are concerned with organizational and financial factors of companies in free zones, leadership factors are more related to the development of human resources. According to Van Den Berghe (2020), effective leadership includes continuous assessment of the organization with the purpose of identifying skills that are most needed for organizational development at a particular moment. Further, these skills should be incorporated into the organization’s staff through training, education programs, and sharing experience with experts possessing these skills (Van Den Berghe, 2020). One best practice for effective leadership is partnering with educational institutions to make sure that employees have an opportunity for professional development (Van Den Berghe, 2020). Leadership directed toward the development of the skilled labor force attracts investors to free zones because it ensures that organizations will be capable of providing investors with the potential for growth.

Interim Conclusion

The success in attracting investors to free zones is determined by marketing approaches, government support, and management and leadership factors. In terms of marketing, free zones should integrate their marketing strategy into the country’s economic strategy and collaborate with various stakeholders to raise awareness about the available investment opportunities. The use of the Internet and influential public figures in promotion is also welcome. The government plays an important role in attracting investors because it can offer different financial incentives and make efforts toward improving the infrastructure and labor force and facilitating the business set up process. Finally, management and leadership factors crucial to attracting investors include the use of best management practices, strong financial position, appropriate qualifications, and the willingness to develop human resources.

Competitors and Their Ways of Attracting Investors

This chapter aims at answering sub-question 2: “Who is the competition, and what channels do they use to attract investors?” First, the major internal and international competitors of Al-Mazyunah will be described and compared. Second, this chapter will discuss marketing channels used by competitors to promote their investment opportunities. Finally, the benefits stated in the competitors’ online marketing materials will be reviewed to find out how the competing free zones attract investors.

The Current Competitors of Al-Mazyunah Free Zone

Interviews with the members of the management staff of Al-Mazyunah Free Zone and the search through relevant sources revealed that the free zone has both internal and international competitors. Within the country, Al-Mazyunah competes with Salalah Free Zone, Sohar Free Zone, and Duqm Special Economic Zone. Its major international competitor is Jebel Ali Free Zone (Jafza), located in Dubai. Each of the competing free zones has distinctive features that are attractive to investors.

Salalah Free Zone is located close to Yemen and is adjacent to the Port of Salalah. It is well-placed to serve African, Asian, European, and US markets (Crowe, 2020). Due to its proximity to the port, the free zone provides international ships with fuel and serves as an entry and exit point for cargoes. Among available facilities, Salalah has office space for rent and business incubators and provides access to an international airport and a deep-sea port. Salalah’s investors are offered a 30-year tax holiday, 100% foreign ownership, and competitive labor cost (Crowe, 2020). There are no customs duties, no minimum capital requirements, and non-restricted repatriation of invested capital (Crowe, 2020). Companies investing in Salalah Free Zone are involved in industrial and commercial activities, logistic services, real estate business, and tourism. For example, the list of current investors of Salalah includes such companies as Octal Petrochemicals, Sapphire Marine, Dunes Oman, and PGC Textile Corporation (Crowe, 2020). The infrastructure consists of electricity, water systems, telecommunications, parking facilities, warehouses, road infrastructure, and 24-hour security.

Sohar Free Zone is situated near Sohar Industrial Port, which is an integral part of the free zone. The location of Sohar is 220 km northwest of Muscat, the capital of Oman, and 180 km away from Dubai, UAE (Crowe, 2020). Sohar provides its investors with access to the Indian sub-continent and East African Coast, and its port can handle the world’s largest ships (Crowe, 2020). The benefits of Sohar include 100% foreign ownership for companies with at least two shareholders and a 10-year tax holiday, which can be extended to 25 years (Crowe, 2020). Like Salalah, Sohar requires no minimum capital and no customs duties. The companies investing in the free zone are involved in logistics and trade, food, metals and steel, petrochemicals, light manufacturing and assembly, minerals, and education and services. The existing investors of Sohar include such Omani companies as Oman Petrochemical Industries Company LLC, Oman Methanol Company LLC, and an Indian company Larsen & Toubro (Crowe, 2020). Sohar Free Zone also has a one-stop shop that serves as a single window in which its investors can obtain all the necessary help with establishing a company.

The location of the Duqm Special Economic Zone (SEZ) is Central Eastern Oman. It is 450 km away from Muscat and 400 km from Salalah (Crowe, 2020). The Duqm SEZ occupies 1,777 sq. km and has 80 km of coastline (Crowe, 2020). The proximity of the zone to the Al Duqm International Airport and the Port of Duqm makes it an attractive investment location suitable for logistic services and international trade. The zone offers the benefits of 100% foreign ownership, a 30-year tax holiday, no customs duty and minimum capital requirements, and no restrictions on capital repatriation. At Duqm SEZ, investors can establish industrial estates, tourist resorts, warehouses and logistic villages, and office, commercial, and residential complexes.

Jafza is a large free zone located in Dubai, in close proximity to Al Maktoum International Airport and Jebel Ali Port. Set up in 1985 with 19 firms, Jafza has grown into a zone hosting more than 7,000 companies (Jafza, 2018). The free zone tries to make the business set up as easy as possible by providing one-stop-shop services, partnering with various service providers, and giving its investors access to e-portal and mobile app. The benefits offered by Jafza include 100% foreign ownership, 50-year tax holidays, and the ability to mortgage premises to a finance company or a bank (Jafza, 2018). The zone imposes no restrictions on foreign employees, capital repatriation, and currency. The industries available at Jafza include warehousing, showrooms, retailing, office and residential complexes, and customized development solutions (Jafza, 2018). It also offers investors plots of land to build facilities for specific purposes. Table 5.1 summarizes the features of the reviewed free zones and compares them to Al-Mazyunah.

Table 5.2. Comparison of Al-Mazyunah with its competitors.

Note. Data for the proximity of seaport and proximity of airport from Healy Consultants Group Plc (n.d.), for commercial activities, omanisation/emiratisation requirement, foreign ownership, corporate taxation, and customs duty from Sultanate of Oman (2016). Data for Jafza from Jafza (2018).

Competitors’ Marketing Channels for Investment Promotion

The competitors of Al-Mazyunah use various online and offline marketing channels. Salalah Free Zone promotes its investment opportunities through its website, on which the major benefits are listed, and the zone’s contact information is provided. Salalah also has a media center that issues press releases to the online and print media and publishes news and information important for investors. Another way in which Salalah promotes its investment opportunities is by attending major industry forums, events, and exhibitions. At these meetings, the free zone has an opportunity to inform investors about its benefits via face-to-face communication. There are also social media accounts of Salalah Free Zone on Twitter, Facebook, Instagram, and YouTube, the links to which are provided on the zone’s website.

Sohar Free Zone promotes investment on its official website by publishing relevant information and providing contact details. Investors can also subscribe to the free zone’s newsletters. In addition, the website has links to Sohar’s social media accounts on Twitter, YouTube, and LinkedIn. The free zone issues its annual magazine, SOHAR Magazine, in which it informs investors about existing investment opportunities and the progress achieved by the free zone. Furthermore, Sohar published news and photos, as well as issues whitepapers that are focused on the zone’s focus on sustainability. The free zone also takes part in various industrial events to promote its investment opportunities and arranges its own ceremonies, for example, to celebrate its anniversaries.

Like Sohar, the Duqm SEZ has an official website that describes the zone’s advantages and contact details and offers an opportunity to subscribe to newsletters. The website has links to the zone’s social media profiles on Facebook, Twitter, LinkedIn, and YouTube. The Duqm SEZ publishes news and videos with investment promotions. The zone’s website has brochures in different languages, including Japanese and Korean, which implies that it specifically targets Asian investors. The Duqm SEZ also issues its magazine, SEZAD Quarterly Magazine, to inform investors about the existing opportunities and the zone’s achievements. Along with the website, the zone has a mobile app that contains information important for investors. Industrial events and forums are also used to encourage investors to set up businesses in the zone.

The website of Jafza is available in English, Arabic, and Chinese, and each version provides extensive information about the zone, its advantages, and the business set up procedure. Jafza has an extensive social media presence, with accounts on Twitter, Facebook, Instagram, YouTube, and LinkedIn. The free zone frequently publishes high-quality photos, posts, and videos. The media center of Jafza issues news on the zone’s website and partners with various media agencies to spread the zone’s latest achievements and information about investment opportunities. Furthermore, Jafza has its print magazine, The Zone, which has also been launched as a digital interactive publication. Additionally, Jafza has its corporate blog where it publishes posts with information useful for investors, for example, about the peculiarities of setting up the business in Dubai. The representatives of the free zone also attend various events and conferences, such as Arab Health and Gulfood, where they promote their investment opportunities directly to investors. Moreover, Jafza hosts multiple special events for its customers, such as its annual Jafza Associates Forum. Table 5.3 summarizes the information about marketing channels used by the competitors of Al-Mazyunah.

Table 5.3. Comparison of marketing channels used by Al-Mazyunah and its competitors.

Overall, the competitors of Al-Mazyunah use multiple marketing channels to attract investors. All the free zones competing with Al-Mazyunah utilize social media, especially Twitter and YouTube, as part of their online marketing strategy. Sohar Free Zone, the Duqm SEZ, and Jafza seem to pay much attention to their marketing, which is evidenced by the quality of their websites, the variety of advertising, and the publication of their own corporate magazines.

An Analysis of Competitors’ Online Promotional Materials

To distinguish themselves from competitors, free zones develop their unique value propositions and state them in their promotional materials. According to Loewendahl (2018), the Internet, especially the corporate website, is the most effective marketing technique for investment promotion. It implies that the information presented on free zones’ websites and in online marketing materials may have the most influence on investors’ choice of investment location. Therefore, this section will explore what benefits the competitors of Al-Mazyunah mention in their online promotional materials.

In an effort to persuade investors to set up a business within its area, Salalah Free Zone focuses mainly on its location advantages and the ease of establishing a company. The free zone emphasizes that it is strategically located on the Equatorial Trade Route, allowing manufacturing companies to have direct access to major exporters of raw materials (Salalah Free Zone, n.d.). The zone is also located at the center of the world trade, which gives it advantages regarding shipping cost and the time of delivery (Salalah Free Zone, n.d.). Another stated benefit is cost competitiveness in terms of labor, infrastructure, and utilities, which can increase manufacturers’ cost efficiency when combined with the mentioned location advantage (Salalah Free Zone, n.d.). Salalah also states that it has a unique benefit of access to Free Trade Agreements, which allows investing companies to reduce costs by obtaining duties exemptions (Salalah Free Zone, n.d.). The zone places much emphasis on its location in Oman due to the country’s economic stability and available government support, such as tax exemptions and the establishment of the one-stop shop.

On its website, Sohar Free Zone attaches much importance to the zone’s proximity to Oman’s largest port and the availability of one-stop-shop services. It also lists such incentives as 100% foreign ownership, 10-year corporate tax holiday, 0% import and re-export duties, 0% personal income tax, and low capital requirements (Sohar Port and Free Zone, n.d.). The zone also mentions the opportunity to extend tax exemptions up to 25 years if the investing company manages to achieve the required omanisation rate (Sohar Port and Free Zone, n.d.). Free Trade Agreements of Oman with the US and Singapore are also included in incentives. Sohar also refers to itself as “the center of Oman’s logistics strategy” and emphasizes its focus on sustainability and innovation (Sohar Port and Free Zone, 2020, p. 14). Thus, like Salalah, Sohar mentions its location in Oman as a significant advantage. However, it distinguishes itself from its Omani competitors by stressing its role in Omani logistics and international trade.

The Duqm SEZ mentions several benefits on its website, such as location, area, accessibility, business-friendly ethos, and clustered development. The zone is strategically located to provide investors with access to markets in South Asia, the Middle East, and East Africa. The occupied area of about 2,000 sq. km is also mentioned as an advantage (Special Economic Zone Authority at Duqm [SEZAD], 2020). Like Salalah and Sohar, the Duqm SEZ promotes investment based on its location in Oman, which entails political stability, tax exemptions, 100% foreign ownership, and no customs duties. There are also unique benefits, such as the issue of permits for foreign employees within five days and 2-year exemption from rental fees (SEZAD, 2020). The zone also mentions the ease of setting up a business with a one-stop shop and a variety of industries available for investment.

Although Jafza also mentions in its online promotional materials that its location in Dubai is a significant advantage, the emphasis in its marketing efforts is put on the zone’s achievements and expertise. Jafza (2018) states that it carefully planned its development, which turned it from an area with only 19 businesses in 1985 into a large entity hosting more than 7,000 firms. One significant advantage is the zone’s logistics platform that includes Jebel Ali Port, Al Maktoum International Airport, Etihad rail, and a highly developed highway network (Jafza, 2018). One-stop-shop services, 100% foreign ownership, the availability of mortgage, and the absence of minimal capital requirements and customs duties are also mentioned as benefits.

Furthermore, the free zone attracts investors by showing its wide portfolio, which consists of plots of land, showrooms, warehouses, offices, retail outlets, business park, on-site residence, and customized development solutions (Jafza, 2018). Only a little attention is given to the zone’s location in Dubai, “the business capital of the Middle East” (Jafza, 2018, p. 27). Thus, while the Omani competitors of Al-Mazyunah mainly focus on their location in Oman and the advantages resulting from this, Jafza puts more emphasis on its achievements.

Interim Conclusion

Al-Mazyunah’s main local competitors are Salalah Free Zone, Sohar Free Zone, and the Duqm SEZ. Its major international competitor is Jafza, located in Dubai, UAE. The common characteristic of Al-Mazyunah’s competitors is that they are located in close proximity to seaports, which is also reflected in their online promotional materials. The competing free zones use varied marketing channels, such as official websites, social media, participation in industry events, media relations, and advertising. Sohar, the Duqm SEZ, and Jafza also promote their investment opportunities in their magazines. As for the benefits stated in the competitors’ online promotional materials, Al-Mazyunah’s local competitors emphasize their Omani location, while Jafza mentions its location in Dubai but focuses mainly on its expertise.

Marketing Tactics and Strategies Used by Al-Mazyunah

As was discussed in the previous chapter, the competitors of Al-Mazyunah use a variety of marketing channels to attract investors. The stated benefits of the competing free zones, which helped them distinguish themselves from other investment locations, were also reviewed. This chapter will describe what marketing strategies are used by Al-Mazyunah, what benefits this free zone emphasizes in its promotional activities, and what marketing channels appear to be the most effective.

The Stated Benefits of Investment in Al-Mazyunah Free Zone

Similar to its local competitors, Al-Mazyunah mentions benefits associated with its Omani location in its promotional materials. These incentives include 100% foreign ownership, the ability to operate without the income tax for 30 years, exemption from customs duties, no minimum capital requirements, and no restrictions on the use of currencies (The City of Free Trade, n.d.). Apart from a favorable legislative environment, Al-Mazyunah notes Oman’s stable political situation and advantageous geographic location. Under “advantageous geographic location” the zone implies that Oman is an appropriate destination for tourism due to its varied sceneries and 1,700 km of coastline (The City of Free Trade, n.d.). Unlike its local competitors, Al-Mazyunah does not mention Oman’s strategic location for reaching the markets of the GCC, East Africa, and the Indian subcontinent. It may be related to a lack of a port in the zone.

The major benefit that Al-Mazyunah highlights in its promotional materials is its proximity to Yemen. The zone is located 4 km away from the border with Yemen and 14 km from Shahn City (The City of Free Trade, n.d.). In addition, Yemenis are allowed to work in Al-Mazyunah without entry visas or permanent residence permit. The reduced omanisation rate of 10% compared to the rest of the country is also a stated benefit (The City of Free Trade, n.d.). These two advantages are supposed to give investors more freedom in hiring the workforce and the ability to employ Yemeni workers easily.

Al-Mazyunah also provides explanations of why easy access to Yemen may be important for investors. The reason for this is that Yemen, with its total population reaching 28 million, is a large market with a purchasing power of about 55.4 billion dollars (The City of Free Trade, n.d.). In addition, Yemen is presented as a country with growing GDP and large exports (The City of Free Trade, n.d.). In Al-Mazyunah’s promotional materials, no information about the civil war in Yemen and its effects on the country’s trade and labor force was mentioned. One possible reason for this is that the zone does not want to discourage investors by mentioning any sources of political instability in the region. Thus, Al-Mazyunah positions itself as a free zone for investors willing to trade with Yemen or have more freedom in the choice of the labor force.

Finally, Al-Mazyunah promotes its investment opportunities by describing the facilities available to investors in the free zone and the industries in which they can invest. Al-Mazyunah lists such essential facilities as the administrative center, showrooms, clinics, a mosque, secondary service center, car dealing stores, commercial stores, warehouses, a hotel, a multi-purpose area, and others (The City of Free Trade, n.d.). The industries that constitute investment opportunities are divided into commercial, industrial, and service sectors (Madayn, n.d.). Investors are offered to set up businesses dealing with import, storage, and re-export of goods; food trade; machinery and equipment trade; sorting and packaging plants; various manufacturing factories, and services such as catering or transportation (Madayn, n.d.). The interview with Madayn’s Director of Marketing and Promotion also revealed that the zone informs investors about the infrastructure that includes road networks, telecommunications, sewage, electricity, and water. In addition, Madayn assures investors that the zone is constantly developing to meet their needs better.

Al-Mazyunah’s Online and Offline Marketing Strategies

As was found during the interviews with the manager of the investment department of Al-Mazyounah Free Zone and the marketing director of Madayn, the promotion of the zone’s investment opportunities is done by Madayn. It is a public establishment that manages and operates not only Al-Mazyunah but also the “Knowledge Oasis Muscat” and seven industrial cities. In contrast, Al-Mazyunah’s competitors are managed and operated by separate companies. Salalah is managed and operated by Salalah Free Zone Company (Crowe, 2020). Sohar is managed by Sohar Industrial Port Company and operated by its subsidiary, Sohar Free Zone Company (Crowe, 2020). The Duqm SEZ is managed and operated by the Special Economic Zone Authority Duqm (Crowe, 2020). As a result, each of these companies promotes investment opportunities available in one free zone under its control, whereas Madayn promotes all entities under its control and tries to give a general overview of investment opportunities existing in Oman. Consequently, Al-Mazyunah sometimes may not receive special attention in Madayn’s promotional activities. Therefore, Al-Mazyunah is assumed to have difficulties distinguishing itself from local competitors, such as Salalah, Sohar, and the Duqm SEZ.

While investigating Al-Mazyunah’s online and offline strategies, the researcher tried to find out whether this free zone makes marketing efforts of its own, in addition to investment promotion activities done by Madayn. Unfortunately, no evidence of Al-Mazyunah’s own marketing activities was found. The interviews with the Marketing Director of Madayn and the Director of the Investment Department of Al-Mazyunah revealed that the promotion of investment opportunities is performed by Madayn. The search through secondary sources also showed that Al-Mazyunah is promoted by Madayn. For example, in 2019, Al-Mazyunah’s investment opportunities were promoted at the industrial and free zones forum in Morocco and at Gulfood 2019 in Dubai, but this promotion was done by Madayn. Thus, it may be concluded that Al-Mazyunah does not perform marketing activities of its own or, even if it does, these marketing activities are less significant than those done by Madayn. Therefore, further analysis will be concerned with marketing efforts performed by Madayn.

Madayn extensively uses offline marketing to promote investment opportunities in Oman, including those existing in Al-Mazyunah. Madayn’s offline marketing involves participation in various trade events, conferences, and industry forums. For example, it was found during the interview with the Director of Investment Department of Al-Mazyunah that Madayn took part in Gulfood 2020, a large annual food and hospitality event in Dubai, and an industry forum in Marocco. Such events present an excellent opportunity for Madayn to communicate Omani investment opportunities directly to investors. The interview with Madayn’s Director of Marketing and Promotion also revealed that, due to COVID-19 restrictions, some meetings with investors were transferred to the digital domain.

For example, Madayn held an online seminar with Indian investors in 2020 to inform them about investment incentives in Oman. Although Madayn’s goal is to attract investment to any of the territories under its control, sometimes, during industry events and meetings with investors, it tells investors in detail about the advantages of investing in Al-Mazyunah. An interview with the marketing director of Madayn revealed that common Al-Mazyunah’s investment benefits that Madayn mentions in its investment promotion activities include the zone’s constant improvement, a 30-year tax holiday, customs exemptions, 10% omanisation rate, the ease of hiring Yemenis, and the ease of getting entry visas and residency permits for non-GCC investors.

Al-Mazyunah has a website located at www.almazunah.com and designed to introduce the free zone and its benefits to investors. The website is available in English, Arabic, Chinese, and Turkish. It contains information about the zone’s goals, investment opportunities and benefits, the geographic advantages of Oman, and contact details. Yet, the information is presented in a way that is not easily readable because of a lack of proper formatting. The website also allows visitors to subscribe to the zone’s newsletters. There is the news section, but the latest news was published in 2013, which implies that the website has not been updated for a long time. It also has icons of social media networks, such as Facebook, Twitter, and Google+. However, these links do not lead to the zone’s social media accounts. In addition, Google+ has not been available since April 2019, which is another indication that the website has been neglected.

Apart from the described website, the information about investment opportunities in Al-Mazyunah is presented on Madayn’s website. Madayn allows investors to explore the map of Al-Mazyunah Free Zone and find out the details about the incentives, industries available for investments, e-services, legislation, and companies operating in the zone. Furthermore, Madayn has accounts on social media platforms such as Twitter, Facebook, YouTube, Instagram, and LinkedIn. As was found in the interview with the Director of the Investment Department of Al-Mazyunah, Madayn uses social media to provide investors with the latest news and advertise Omani investment opportunities. Madayn’s social media profiles were reviewed, and it was discovered that Madayn gave more attention to its industrial cities, while Al-Mazyunah was rarely mentioned.