Alternative market entry

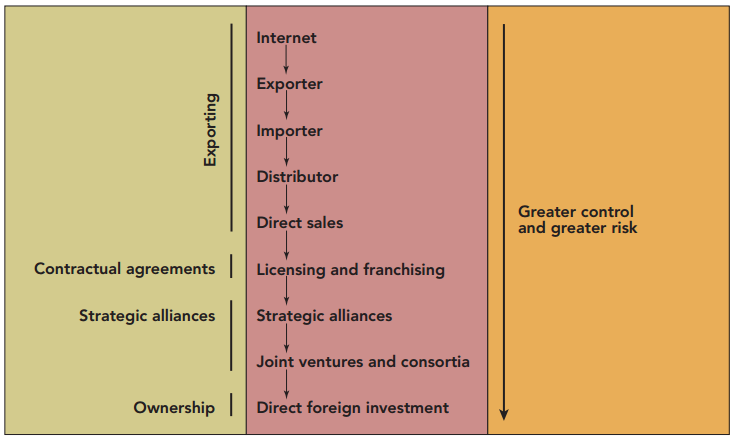

The four different techniques that a firm may utilize to enter the market are contractual agreements, direct foreign investment, exporting, and strategic alliances. The modes are further categorized based on either the equity or non-equity needs of each approach (Cateora et al., 2011). The magnitude of the desired equity by a company to utilize diversified ways influences the return, risk, and governance over each strategy, and sales proceeds growth undergoes various stages.

Exporting

A substantial percentage of the global economic involvement comprises exporting, which can exhibit as either direct or indirect. Direct exportation occurs when the firm sells goods to consumers of other states. The scheme is often ideal for companies considering exploring international markets because they can reduce financial loss risks(Cateora et al., 2011). Conversely, indirect exporting exists where the manufacturer sells products to buyers within the home country who later exports the goods.

The Internet

The Internet plays an immeasurable role in the foreign market entry as the company starts its operations eyeing the domestic sales but later receives orders from clients residing in overseas countries who advance international internet marketing. The Internet facilitates the transmission of catalogs, smartphone snapshots, direct emailing, and harbors platforms for video conferencing equipment and accessories(Cateora et al., 2011). Further, the internet also fosters direct sales where the consumers make and pay for orders online, and the vending companies receive payment instantaneously.

Contractual Agreements

Contractual agreements are extended non-equity engagements between one firm and another in an overseas market. The agreements often involve the exchange of technology, human skills, trademarks, and processes. Therefore, they seek to advance knowledge transfer instead of equity and it is executed through licensing and franchising. The former entails the establishment of bases in foreign markets without committing substantial capital expenditures. Notably, the trademark rights, patent rights, and authority to apply technological knowhows are accorded in foreign licensing (Cateora et al., 2011). In addition to entry into an overseas market, licensing supplements manufacturing and exporting. The benefits of licensing are garnered when the capital is limited, import constraints prohibit other market entry modes, and when the state upholds diplomacy for foreign patents, ownership, and trademarks.

Franchising is a way of licensing where the franchiser is tasked with the constant supply of products, management services, and systems, while the franchisee offers capital, market intelligence, and active involvement in governance. The integration of capabilities allows flexibility in handling domestic market settings and accords feasible control to the parent company. The franchiser undertakes the promotion of the products at the point of ultimate sale (Cateora et al., 2011). Remarkably, the franchise system offers effective centralization of skills and decentralization of operations. As a result, franchising is the first-hand strategy employed by firms exploring foreign retail businesses in emerging market economies. However, franchising approaches are hampered by the principal’s international know-how, surveillance costs, and brand equity in the novel market.

Strategic International Alliances

A strategic international alliance (SIA) is a corporate entity formed by at least two firms to collaborate due to the shared need and spread risk in attaining a collective goal. The significance of SIAs has grown tremendously in the recent decades as a competitive scheme in the international management of marketing. Consequently, SIAs are started to eliminate marketing weaknesses and boost competitive force (Cateora et al., 2011). Companies join SIAs for easy accessibility to opportunities for quick expansion into new markets, acquire advanced technology, accrue lowered marketing costs, and obtain supplementary sources of capital and products.

International Joint Ventures

International joint ventures (IJVs) are established to reduce economic and political risks by an extent equivalent to the individual stakeholder’s contribution to the entity. Additionally, IJVs offer a less risky means for admission into markets that engender cultural and legal impediments(Cateora et al., 2011). A joint venture differs from strategic relationships and alliances since it is initiated through a partnership of at least two collaborative firms with the objective of forming an independent legal entity. Due to IVS management challenges, quality correlations amongst executives and partners are essential for successful operations.

Consortia

Consortia are ventures that encompass several contributors and often operate in states where none of the parties is a market player. They are created to amass managerial and financial resources and mitigate the inherent risks. When firms come together to form a consortium, one company assumes the lead role or agrees to run the newly formed separately from its pioneers (Cateora et al., 2011). Through the consortium, the firms broaden their individual investment portfolio to incorporate new opportunities. Further, partners have to agree on their business plan for smooth coordination and running of consortia.

Direct Foreign Investment

Companies undertake local investment to exploit cheap labor, circumvent high import levies, minimize high transportation costs to markets, and access readily available technology and raw materials. Firms enter the market by instituting new functional facilities, acquiring local companies, or investing in pre-existing ventures (Cateora et al., 2011). Market entry through direct investment is affected by the timing, the variabilities and complexities of contracts, structural transaction costs, extent of product uniqueness, and knowledge and technology transfer.

Alternative Middleman Choices

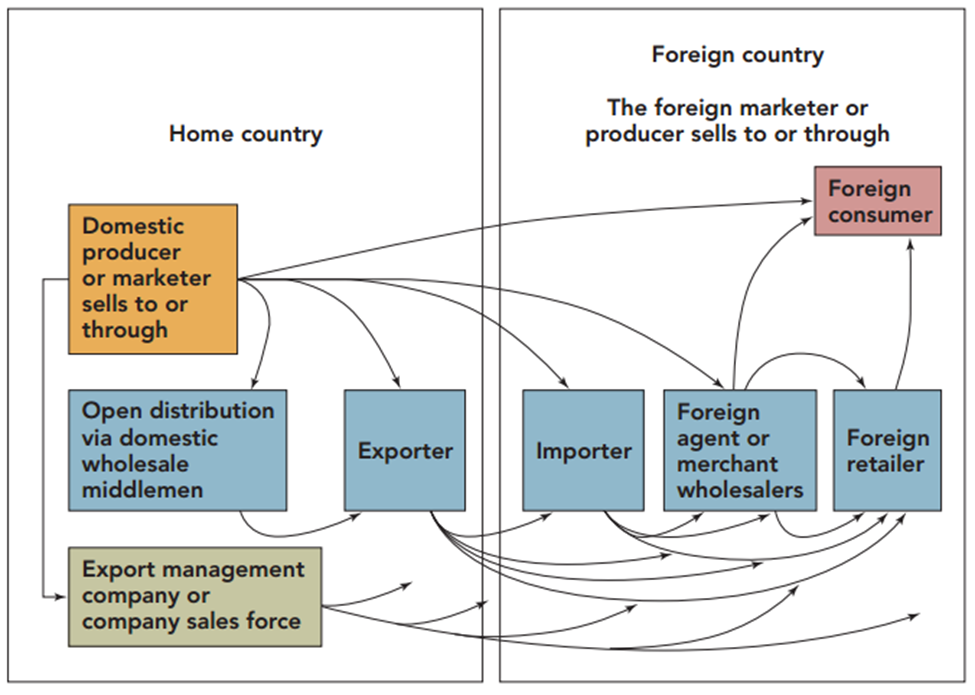

Marketers have the option of skipping the whole distribution channel by instituting their individual subsidiaries and supplying directly to the consumers or relying on mediators for product delivery to the end-users. The distribution process involves the entire activities starting from the manufacturer’s undertaking to the final client (Cateora et al., 2011). The producer establishes a firm in the home country to deal with all channel players and inter-countries product movement and assumes supervision of supply channels in foreign markets.

Nevertheless, direct involvement in the entire supply network is unfeasible, necessitating selecting external intermediaries who pledge alignment with the company policies and objectives. The intermediaries are classified into agent middlemen or merchant middlemen (Cateora et al., 2011). The former trades on a commission basis and steers sales in the overseas market without acquiring the merchandising title. However, the latter uses the manufacturer’s label and trading risks while wholesaling and retailing in other countries.

Domestic middlemen are situated in the home country of the manufacturing company and offer marketing services locally. Domestic intermediaries provide numerous benefits for those firms with little international sales capacity, reluctant to be directly involved in global marketing complexities, and inexperienced with foreign retailing (Cateora et al., 2011). Further, manufacturers’ retail stores are owned or franchised merchandizing reservoirs used by large producers as one of their distribution channels. Conversely, global retailers serve as domestic vendors in the universal markets for inexperienced firms wishing to enroll in international markets.

Export management companies (EMC) acts as middlemen for corporations with moderate worldwide sales volume or those not ready to engage their own staff directly in multinational operations. The EMCs vary in size and eventually get incorporated by client firms in their marketing functions. Export trading companies (ETCs) are establishments that deal with similar export goods (Cateora et al., 2011). Complementary marketers, manufacturers’ export agents, Webb-Pomerene export associations, and foreign sales corporations also play a crucial role in product marketing.

Foreign-country intermediaries bring the producer adjacent to the overseas market and assist the firm in physical distribution and resolving communication and language barriers. The intermediaries may be hired temporarily for particular tasks or serve as the manufacturer’s foreign suppliers and representatives (Cateora et al., 2011). Finally, government-affiliated middlemen are states’ purchasing offices in every country that deals with marketers’ commodities, services, and products for regulatory purposes and procuring for the government.

Factors Affecting Choice of Channels

Before performing channel selection, international marketers should explicitly identify the prospective market and outline their marketing objectives (market share, volume, and trade proceeds). Further, marketers must establish terms of sale, control, channel ownership, and length of channels and stipulate personnel and financial obligations for domestic and international distribution progression (Cateora et al., 2011). Decision-making in distribution considers fundamental elements like intermediaries’ functions, availability, cost of their services, and ability to control them.

Channel costs transpire in the form of capital cost required for channel development and recurrent cost to sustain the firm’s selling power. Marketing costs exist as the total variance between the product’s factory price and the end-user’s payment for the goods (Cateora et al., 2011). Notably, expenses by middlemen are incurred during transportation and goods warehousing, bulk-breaking, local adverts, and offering credit services. Shortening of channels requires eliminating inefficient brokers since intermediaries cannot be abolished altogether.

The establishment of internal channels (sales force) by a firm requires optimum investment. The monetary ramifications in distribution oblige the manufacturers to utilize dealers and distributors to lower capital financing (Cateora et al., 2011). However, the producers have to furnish starting consignment inventories, floor plans, loans, and other business essentials to suppliers with no capital capacity. To gain control over distribution, manufacturers accord more capital funding and assume supervisory roles.

A company exerts more influence in the distribution by being more actively involved. Huge overheads are often required for a firm’s sales force to uphold maximum control in the market. The capability to regulate price, promotion, volume, and kind of channels diminishes with the increase in the outlet’s length (Cateora et al., 2011). When a firm does not vend directly to retailers or consumers, it maintains influence by deploying appropriate criteria for intermediaries’ selection.

Sufficient market coverage is vital to amass maximum sales volume from every market portion, acquire a substantial market share and achieve reasonable market infiltration. The determinants for coverage include the geographic constituents and the market bit. Sufficient market coverage necessitates frequent modification of distribution infrastructure from one country to the other (Cateora et al., 2011). Stiff competition hampers coverage expansion in highly developed areas, while insufficient channels hinder extension in sparse markets.

The preferred system of channel-of-distribution must have the acceptable character of the firm and the prevailing markets. The key considerations in product specifications include its value, perishability, bulkiness, sale complexities, and required sales services (Cateora et al., 2011). Finally, the selected channel of distribution should nurture business continuity and alleviate longevity challenges. Consequently, manufacturers have to ensure downstream brand loyalty enhancement to prevent a shift of allegiance by distributors, dealers, and intermediaries to competitors.

Creative Challenges

Legal Constraints

Laws governing comparative advertisements differ from one state to the other, and invoking any illustrative expressions by any company may occasion suing by their competitors. The guidelines entailing allusive promotions permit implicit analogies that lack mentioning of competitors but prohibit explicit comparability amongst the stated products (Cateora et al., 2011). Despite the call to have harmonized rules to regulate the advertising arena, every country has the liberty to enact laws that address the exposition issues within their jurisdiction. Subsequently, the member states may bar companies that fail to comply with the directives guiding advertising within their borders.

Disallowing uncensored comparisons promotes effective advertising strategies by companies, both at home and in foreign states where authorized to operate. Lifting of restrictions curtailing comparative adverts also requires global marketers to reflect on the consumers’ feedbacks for alignment with their innovative advertising campaigns (Cateora et al., 2011). Equivocally, adverts on televisions are highly monitored in many countries, with some restricting ads promoting liquor, tobacco, publishing, press, cinema, and toys.

Nevertheless, there are disparities amongst countries regarding adverts on product placement. For instance, China has few laws to regulate the posting of commodity ads. In contrast, the European Union (EU) does not restrain the placement of EU-generated goods but limits the foreign-produced material (Cateora et al., 2011). Nevertheless, commercial advertising should be controlled to eliminate formidable illustrations, contests, ethnic ridicule, offensive words, undignified dancing or dressing, frightening exposures, hostility shots, or competition incursions. Additionally, internet services are susceptible to discriminatory imposition of advertising guidelines because regulations are enacted selectively amongst countries. Some states also enforce special taxes on advertisements, which handicap creative autonomy in media selection and online activities.

Linguistic Limitations

One of the greatest barriers hindering effective communication during advertising is language diversity. The challenge encompasses distinct dialects within a country or existing language in different states. Further, the problem is occasioned by the subtler setbacks of linguistic tone, vernacular nuance, accent, and style of argument. Since most countries preserve their languages for cultural pride, the impetuous handling has resulted in marketing hitches globally. This is because the manufacturers often translate their advertising themes inappropriately while trying to reach prospective buyers in foreign countries (Cateora et al., 2011). The perilous interpretation arises from the use of words that convey divergent meanings in various countries. Most of the time, the employed words often transform to obscene expressions upon interpretation by the targeted market. Some of the words which engender disparate implications on rephrasing include tomato, ball, and pad.

Moreover, language causes countless obstacles that prevent effective translation of idioms, thus, impeding correspondences. The inherent hindrance is often witnessed on the internet and numerous advertising materials. The translators find challenges dealing with succinct writing, abstraction, and word economy, which constitute the critical tools for an outstanding advertiser. Further, communication is hindered by the significant education and cultural heritage diversities that prevail among countries and triggers differing understandings of simple sentences and concepts. Some states attempt to alleviate translation challenges by engaging foreign expatriates, but the efforts are thwarted by the increasing changes in the meanings of words amongst diverse cultures. In most states, the low literacy levels are another hitch that deters greater creativity and adoption of verbal communications (Cateora et al., 2011). This is because the countries have multiple languages within their borders, which poses a problem to the advert sponsor.

Cultural Diversity

Communication with people from diverse cultural settings presents significant creative problems in product advertising. Communicating is quite challenging because cultural influences dictate the perception of different phenomena. Consequently, variation in the perceptual context results in corresponding discrepancies in message understanding. Therefore, discernments based on customs and heritages often make product promotion campaigns unproductive or infeasible. The international advertiser ought to familiarize themselves with the overseas languages and cultures to avoid product rejection by consumers. Understanding the diversities in music, gender appeals, and celebrities across cultures also matters for effective advertising. The advertisement should also not employ intricate and strange features that trigger confusion amongst the end-users (Cateora et al., 2011). Finally, the advertiser should pay attention to the subcultures in a country. This is because the youthful generation of a country has distinct consuming patterns from the older persons due to the changing traditions.

Media Limitations

Restrictions on creative approaches foisted by media may lower the responsibility of adverts in the promotional campaigns. The limitations may also oblige marketers to focus on other components of the awareness mix (Cateora et al., 2011). The creativity of a marketer is restrained when commercial televisions provide few slots for ads within a year. In order to overcome these media constraints, advertisers are often forced to develop their media outlets.

Product and Cost Limitations

Creativity is desirable when a firm is experiencing financial constraints or adverse production deterrents like the lack of superior paper grades and low printing quality. The need for low-cost replication in small-scale markets stirs further challenges in most states (Cateora et al., 2011). This is occasioned by the limited complimentary resources for advertising like billboards and televisions. Subsequently, many companies adopt alternative mechanisms to attract attention towards their adverts and products.

Approaches to International Pricing

Orientation of prices by firms requires utilization of either variable-cost pricing or full-cost pricing. The former requires the company to concentrate on the incremental or marginal expenses of manufacturing goods tailored to be traded in foreign markets (Cateora et al., 2011). Conversely, full-cost pricing asserts that similar products have analogous expenditures, and each of them should bear total variable and fixed costs equally. The strategy is suitable when a firm has higher variable costs than fixed overheads.

Depending on the competition levels, a company may adopt either a skimming or penetration pricing policy. Skimming is embraced when the firm aims to cover a section of a price-insensitive market that is ready to pay more for the received commodity. The approach is best suited for companies with limited supplies wishing to optimize their revenue (Cateora et al., 2011). On the contrary, penetration pricing strategy involves deliberate retailing of products at low prices to trigger sales and market increment. Therefore, the policy is employed as a competition scheme to obtain and retain a market share.

Nevertheless, the market props a competitive product price, irrespective of the standard pricing strategies and policies employed. Subsequently, countless goods are traded in very small quantities in diverse markets to normalize the ideal unit price for consumers (Cateora et al., 2011). Further, growth in a country’s economy favors equitable distribution of wealth amongst citizens, development of multiple income status, and emergent of discrete market sectors. Additionally, wealth evolution in a state introduces numerous pricing levels for varied quality impressions. Therefore, appropriate pricing resolutions of a firm focusing on a sole market segment permit more elaborate conventions.

Reasons for Price Escalation in International Markets

Price escalation may arise due to the costs of exporting that emerge from the extreme price variation between the importing and exporting states. The final prices are influenced by shipping costs, tariffs, special taxes, insurance, administrative costs, packing, lengthy distribution channels, high intermediaries’ margins, and fluctuations in the exchange rate. Import certificate fees and other administrative processing charges and turnover or value-added taxes imposed on some goods raise the product’s final price (Cateora et al., 2011). Additionally, tariffs that govern foreign competition, which is the core discriminatory tax, add to the total export cost.

Further, inflation contributes to market escalation since the selling price of a commodity has to be compared with the cost of items sold and the price of replenishing them. Inflationary factors are also considered during long-term contract engagements or in instances where the payments have the likelihood of being held for some months (Cateora et al., 2011). Conversely, deflation aspects occasioned by the drop in consumer prices from the high costs during manufacturing or procurement by dealers cause economic disproportion. However, for a firm to uphold consumers’ trust in a deflationary market, it should increase the brand value while maintaining low prices.

Despite the major currencies shifting freely relative to each other, exchange rate fluctuations also cause price variabilities. Consequently, companies enforce the transaction proceeds to be drafted in terms of the supplier company’s domestic currency. This is because the exchange rate differential amounts may be huge for extended durations between order signing and actual goods delivery (Cateora et al., 2011). Finally, brokers and transport costs engender price escalation as there are no standardized margins for intermediaries, and marketers may also incur extra expenses for small consignment handling and warehousing.

Approaches to Reducing Price Escalation in International Markets

Lowering the cost of goods by the producer causes a subsequent decrement in prices in the entire distribution chain. Elimination of expensive intricate features and minimizing overall item quality during manufacturing helps in curbing price escalation (Cateora et al., 2011). Whenever the most significant proportion of price escalation emanates from tariffs, goods are reclassified into various ancillary customs categories. The classification offers varying rates between wholly assembled products and those requiring extra processing and some assembling using the locally produced parts and components.

Channels with minimal intermediaries are shorter and lower the distribution costs due to the reduced margins of brokers. Abridged distribution outlets also help in the price regulation since the overall cumulative taxes passed via the channels are reduced. This is because the collective value-added tax depends on the total selling price and is computed when the products are transferred to other handlers. On the verge of lessening the price escalation, some states have also instituted free trade zones (FTZ) or free ports to ease intercontinental trade (Cateora et al., 2011). FTZ facilities facilitate global handling, processing, or storing of imported commodities.

Finally, dumping lowers cost escalation as it involves either selling products at relatively lower prices than their production cost or fees lesser than the cost of similar items in the home state. However, a countervailing duty is imposed during transportation or export to limit importation for the benefitting country (Cateora et al., 2011). Countervailing taxes are foisted upon ascertaining that the importing states’ prices are lower than the exporting country’s rates, and the former’s manufacturers are directly affected by the disposal. In an archetypal dumping case, prices are conserved in the source country and decreased in the overseas markets.

Reference

Cateora, P., Gilly, M., & Graham, J. (2011). International Marketing (15th ed., pp. 344-538). McGraw-Hill.