Contemporary theories provide several definitions of marketing, with the most popular one to envision it as a process of creating, communicating, and providing products to end customers targeting to satisfy individual needs. However, to identify and fulfill the needs, wants, and demands of different consumer groups, it is important to operationalize market orientation through the use of different concepts or philosophies. On the organizational level, it is critical to define how specific marketing philosophies are used to guide business management process that links together customer focus, profit orientation, as well as harmonizes activities of the marketing department with other functions (Taghiporian and Bakhsh, 2017). Hence, market orientation is operationalized based on foundational ideas of customer centricity to understand expectations, accommodation of business goals with customer needs, and integration of marketing activities across business units (Najafi, Sharifi, and Najafi, 2016). Considerably, through the lenses of earlier theories, marketing might be defined as a process, while in a broader context, it is more fluid and involves considering multiple organizational specifics and, therefore, is best described as a philosophy.

There are five most popular marketing philosophies or concepts that are actively practiced in organizations. The first is the production concept, which is utilized to create inexpensive and broadly available products to meet the cost-saving expectations of the customer. The second is product concept, which is the opposite to the previous one and suggests that higher product quality and exclusivity could be effectively sold at a higher price (Ho et al., 2018). The third is the selling concept, which implies that apart from product and production parts, it is important to invest in advertising since the goods will be rarely sold otherwise. The fourth is the marketing concept, which argues that organizations should learn as much as possible about their customers before creating and selling the product. Finally, the fifth is the societal marketing concept, which extends the previous one and requires considering social well-being and environmental needs in product development and communication (Kamboj and Rahman, 2017). Hence, these concepts will be further validated based on the case of Medtronic, one of the global industry leaders currently operating in healthcare services.

Company Introduction

Medtronic is a healthcare service company that produces and supplies medical devices and currently operates in more than 140 countries. Because of the history of its acquisition of Covidien, it exists as an American Irish-domiciled organization that is headquartered in the Republic of Ireland after the major tax inversion while has an operational and executive team in the United States (Crow, 2015). In May 2018, Medtronic was recognized as the largest medical device organization with revenues of $29,710 million (Ebeling, 2019). Currently, it has four business units occupied in minimal invasion therapy, diabetes, restorative therapies, and cardiac and vascular diseases intended to support the provision of healthcare services in more than 30 chronic diseases (George and Baraldi, 2017). Considerably, Medtronic specializes in offering medical devices for healthcare facilities that provide treatment for patients with chronic health issues around the world by producing and shipping special devices relevant to the expertise of a particular business unit.

Being a medical device supplier, Medtronic experience heavy pressure on its reputation for the identified and potential failure of their products, which eventually intensifies its competition in the healthcare service market. For instance, in February 2020, the company had to recall 322,000 branded insulin pumps with faulty components, which was correlated to one death and approximately 2,000 injuries and therefore resulted in reputational losses (Scripps National, 2020). On the global market, the company competes with three major companies that might eventually overtake its market shares. The first is Boston Scientific Corporation, located in the United States and specialized in producing medical devices for interventional medicine. The second is Sanofi S.A., a French-based pharmaceutical company that primarily benefits from the revenues in prescription sales while also actively engages in therapeutic treatment research and development. Finally, the last major competitor is Olympus Corporation, a Japanese manufacturer of medical, surgical, scientific, and industrial equipment. Considering the size and history of the described organizations, Medtronic should consider having a flexible marketing strategy that encapsulates various concepts and philosophies to effectively target different customers across the geographies it operates in.

Analysis of Operating Environment

During the recent five years, Medtronic primarily focused on international business expansion through acquisitions. These efforts were underpinned by the three major growth strategies of therapy innovation, which assumed releasing new and meaningful therapeutic procedures; economic value, which relates to a transition towards value-based healthcare and globalization, which meant to confront inequity in healthcare services provision in developing markets. The contribution to these statements was initiated from the largest medical device business acquisition of Irish Covidien in 2014, which allowed the company to majorly extend its product line from the ones designed in-house to the others introduced by smaller medical device companies. Further business expansion efforts were mainly concentrated on acquiring innovative technologies from the smaller companies that try to experiment with the use of technology in the healthcare industry; however, internal research and development efforts were practiced as well. Consistently, Medtronic was seeking to make a shift from the volume-based to the value-based business model, where a typical healthcare approach of requiring consumers to pay for the volume of received service is replaced with the need to pay for the quality.

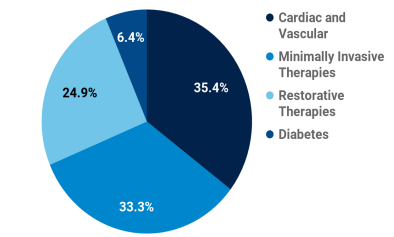

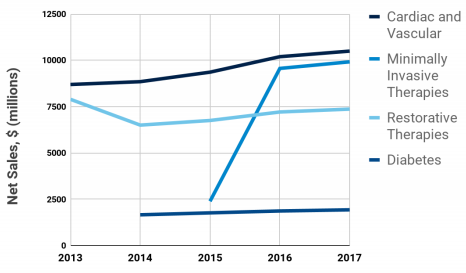

The focus on acquisitions is further explained by the market size of the four business units. As shown in Figure 1, cardiac and vascular and minimally invasive therapy business units were the most revenue-generating segments in 2017, unlike the diabetes unit. However, Figure 2 also shows that the dramatic change after the acquisition of Covidien was primarily observed for the major growth of the minimally invasive therapies sector, which has outperformed restorative therapies in less than two years. Consistently, as the company redesigned its market segmentation approach, it faced a unit-focused competition from the other companies dominating in the specific healthcare services direction, including Baxter, Abbott, and Johnson and Johnson.

With respect to the described operational activities, the company started to actively deploy an idea of value-based healthcare, which suggests that patient visits and outcomes should be rewarded at lower costs and require designing new processes and approaches in healthcare delivery. Specifically, as was admitted in one of the interviews conducted with Medtronic’s CEO, the company contributed to the deployment of the ‘bundled payment’ methods, where the rewards should be acquired based on the complete cycles of care rather than the number of visits. Specifically, the company outlined three imperatives that are most relevant for the growing healthcare market with never-ending opportunities based on its social importance. First, it is important to continuously improve clinical outcomes given that health care will always be demanded, and, therefore, the use of technology and information is critical to provide better outcomes. Second, it is required to expand access to healthcare services in emerging markets, where health issues might be poorly addressed comparing to the developed world. Finally, it was stated that the optimization of costs and efficiencies with respect to poor consumer awareness of how to value and pay for traditionally expensive healthcare costs.

The practical application of the aforementioned value-based philosophy was further realized by renovating the business model and customer-centric relationships. First, the company deployed an outcomes-based reimbursement model with major American health insurers related to the provision of insulin pump systems (Deloitte, 2018). Specifically, the model assumes that there is a risk-sharing approach among payer and manufacturer, where the cost of the product is compensated only if the medical devices contribute to the optimization of glycated hemoglobin level after the treatment rather than prepaid (Deloitte, 2018). Further, Medtronic introduced its own CareLink electronic network, which is associated with a remote monitoring system to control the operational performance of implantable cardiac devices and allows clinicians to interact with it using a website. Specifically, it was admitted that the implementation of CareLink allowed to decrease the time of clinical event detection to a clinical decision, therefore reducing the frequency of emergency visits among the patients with a heart failure symptom (Deloitte, 2018). Finally, Medtronic was able to further enhance its Integrated Health Solutions (IHS) department aimed to foster long-term business partnerships with hospitals, physicians, and physical service payers, resulting in 170 ongoing agreements initiated across 24 countries.

Analysis of the Value Creation Approach

The analysis of Medtronic’s operational environment suggests that the company has shifted its value creation approach from product-oriented philosophy towards the societal marketing concept, where the importance of delivering integrated, cost-effective, while socially responsible services is a central idea of the future business strategy. The core business thinking behind is to further utilize value-based healthcare services across all segments and further penetrate into emerging markets to drive innovation, availability of services at lower costs, and use technological advancements to support these endeavors (Harvard Business Review, 2017). Strategically, this approach assumes that Medtronic seeks to increase loyalty and enlarging the base of existing customers through tailoring its services to meet existing market affordability. Meanwhile, the company also focuses on the scope of services provided within existing business units and attempts to acquire smaller medical device providers to improve the quality and availability of products rather than significantly expands into other therapeutical areas (Harvard Business Review, 2016). Considerably, its value creation approach both differences and similarities with those utilized by its primary competitors.

Comparing marketing philosophies used by Boston Scientific and Medtronic, it is worth admitting that the former has a more diversified product portfolio acquired and developed both through acquisition and internal research and development capabilities. The four value propositions offered by the company are brand, accessibility, risk reduction, and innovation, with the last being practiced earlier than Medtronic did. For instance, Boston Scientific was initially focused on acquiring manufacturers of niche medical products, which allowed it to specialize in creating a broad variety of products in a wider range of medical specialties not covered by Medtronic business units (Cleverism, n.d.). The company has also championed a suite of training and educational programs known as EDUCARE, which are multidisciplinary and offered through the nine centers of its corporate institute for advancing science. Furthermore, taking a value-driven structure as a basis for the marketing philosophy, the company has initiated several partnerships with medical researchers through the Investigator-Sponsored Research Program (ISRP), which serves as a basis for advancing scientific knowledge through promising medical interventions (Baeza et al., 2017). Hence, Boston Scientific creates value through the accumulation of internal organizational knowledge, while Medtronic more actively explores external channels.

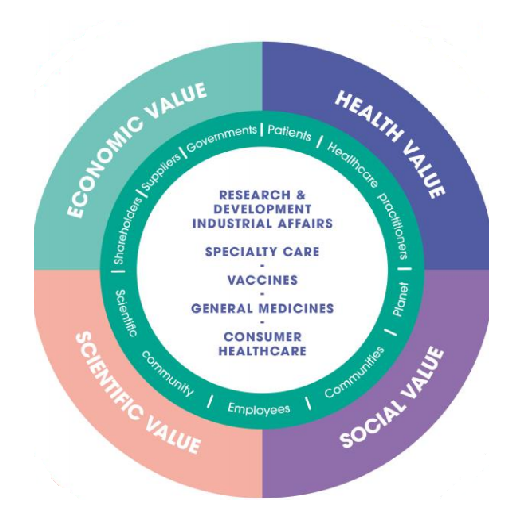

On the contrary, the value creation model utilized by Sanofi as a competitor should be seen as an integrative one, which comprises elements of economic, scientific, health, and social values. The economic component of the model measures dividends paid to shareholders, the amount of money paid to suppliers, and taxes paid from the revenues. The scientific component evaluates efforts in transformative medical projects related to addressing progressive diseases, as well as the number of projects that were officially validated for clinical development. The health value is estimated similarly to Boston Scientific, where the number of healthcare professionals trained, the increase in productive partnership agreements, and pharmaceutical contributions are cumulatively considered as an indicator of business efficiency. Finally, the social value represents plane mobilization efforts through decreasing water consumption and carbon emissions, awarding work-study contracts for fellow researchers, and maintaining gender parity among company employees (Searcy, 2016). Hence, Sanofi pursues a combination of production and societal marketing philosophies by elucidating several frameworks that represent business contribution in four distinct areas of activity.

Finally, Olympus Corporation has also recently redesigned its value creation approach by announcing an ambitious goal of becoming the greatest “business to specialist” medical services company. The philosophy behind the statement is that company seeks for the acute understanding of the needs of healthcare professionals, specialized customers, and researchers. Therefore, the value creation method assumes that the company will focus on creating a shared value with specialists, customers, and partners collaborating in a single framework (Harris, 2019). Specifically, it is mentioned that supporting specialists by the business is critical to support societal issues of increasing pressures to restrain medical costs, addressing the needs of emerging markets, and the need to integrate industry structure changes because of the proliferation of information and communication technologies (ICT) (Harris, 2019). Further, it is anticipated that focus on these needs will help to resolve the issues by leveraging highly specialized skills in core operational areas of medical, imaging, and scientific solution businesses currently managed by the company (One Olympus Report, 2017). Overall, these views are consistent with the value-based vision applied in Medtronic, while also customized per past business delivery models practiced in Olympus Corporation.

Evaluation of Marketing Strategy Implementation

Medtronic has made considerable efforts to outperform its competitors, which is supported by healthcare service company ratings and reported revenues. However, further analysis is required to understand if Medtronic efficiently leverages its resources and achieves a competitive advantage in the market. Overall, the strategy is based on leveraging core and distinctive competencies that correspond to the mission, vision, and corporate values pursued by the company. For the case of Medtronic, as well as any other medical device producer, it is critical to ensure that the product is thoroughly researched and inspected in terms of quality internally and further approved by the Food and Drug Administration (FDA), accepted by the market, and adopted by clinicians or physicians (Kaplan et al., 2018). It means that Medtronic should be capable of effectively positioning its facilities and resources for promoting high-quality standards, as well as regularly undergo certifications of International Standard Organization (ISO) (Niero and Rivera, 2018). Since Medtronic has been recently rated as a reputable company by business journals such as Forbes and Harvard Business Review, it is worth considering that one profoundly controls its image in public and maintains quality standards.

Alternatively, a differentiation strategy that applies to any public company relates to distinctive competencies that allow comparing single company activities to its competitors. For the case of Medtronic, those are best described as growth strategies, a comparatively large number of patents, and a focus on innovation (Kaplan et al., 2018). The analysis performed in the previous section suggests that the company actively spreads the knowledge and utilizes practices related to value-based healthcare. It allows to solidify its brand name and reputation in the eyes of consumers, as well as engage in new research and development areas. Furthermore, the company was effective in acquiring several smaller companies, which increased its patent base and, therefore, officially limits the entrance of other competitors for partnership with customers who use Medtronic’s services. In addition to that, patents in niche areas of medical services enhance company exclusivity in providing equipment for healthcare organizations that deal with unusual diseases and comorbidities, which gives an opportunity to enlarge the partnership network without extensive competition (Martin, Javalgi, and Ciravegna, 2020; West, 2016). Meanwhile, it is important to maintain high-quality standards given the overall business sensitivity and losing loyal customers otherwise.

Using the SWOT analysis methodology, the following findings are summarized for the Medtronic:

- Strengths: A high number of patents and overall intellectual property stance allows the company to create barriers of entry for competitors through copying the functionality or design of a particular medical device. Furthermore, high-quality devices in niche sectors improve the brand name recognition and eventually lead to developing the economies of scale in merging markets through leveraging value-based philosophy (Jobber and Ellis-Chadwick, 2019).

- Weaknesses: Based on the number of recent acquisitions, the company might eventually face financial problems if any of its innovative integrations will fail. Recent reports of patent infringement cases also result in additional expenditures for managing lawsuits, which creates reputational and revenue generation risks (Nielsen, 2019).

- Opportunities: Despite the recent acquisitions, the company still has an outstanding diabetes business unit that accounts for less than 7% of its business revenues, as shown in Figure 1 (Carter, 2018). Apparently, it is reasonable considering the estimated growth of the diabetes healthcare service market and make certain investments in the development of a specific intervention strategy. Furthermore, given that the major portion of revenues is acquired from the U.S. market, the company should consider stronger market penetration and consumer targeting in emerging markets.

- Threats: While the current market position of Medtronic is strong, it is still engaged in the competitive rivalry on both global and sector-specific markets. Moreover, some of its competitors, such as Boston Scientific, are more profound in alternative therapeutical areas and therefore might be awarded new contracts faster based on the investments made in research and development. The market acceptance is another risk area, which suggests that in a new market, the company should pass a chain of verification procedures by various stakeholders such as government, FDA or similar local organization, and medical personnel as main customers (Breuer et al., 2018).

Based on the mentioned above, Medtronic is highly advised to consider expanding its services to other medical areas, as it was previously done by Boston Scientific. Similarly, it might consider developing a two-sided marketing communication approach that engages stakeholders similar to the one utilized by Olympus Corporation to ensure a transparent understanding of internal and external business activity integration. Meanwhile, it is important to use a personalized marketing approach while communicating new services to potential customers, which implies the need to focus on alternative markets such as India or China rather than the United States. It will require extensive market research and search for partnership, which means that one is a long-term goal that will require resourceful planning, competitive landscape scanning, and stakeholder engagement.

Another recommendation is to consider an opportunity to enhance understanding of the value-based healthcare services in emerging markets by providing opportunities for the ‘bundled payment’ at costs lower than accepted for developed countries. Eventually, it will create an opportunity to promote and expand the services provided by the diabetes business unit, suggesting that the healthcare condition for this diagnosis in rural areas is poorly investigated. However, it also requires initial benchmarking and the appropriate choice of marketing communication strategies with customers who might demonstrate cultural intolerance for the foreign healthcare services supplier.

Finally, it is proposed to consider performing more robust internal audits to ensure that the reputation of the company is not damaged and entire product shipments, as the case of 2012 shows, are not required to be canceled. The healthcare service industry is highly sensitive, and a single failure in applying quality checks might result in revenue and customer loyalty losses, which would be complex to regain for a short period of time. However, it should be acknowledged that quality complaints in some cases might arise from unmet expectations that were not initially agreed with the customer; hence, those might be improved with discounts and value-based loyalty programs.

Reference List

Baeza, R. et al., (2017). Boston Scientific: creating a bold strategy. BCG Henderson Institute. Web.

Breuer, H. et al. (2018) ‘Sustainability-oriented business model development: principles, criteria and tools’, International Journal of Entrepreneurial Venturing, 10(2), pp. 256-286. Web.

Carter, J. (2018) A strategic audit of Medtronic PLC. Honors Thesis. University of Nebraska. Web.

Cleverism (n.d.) Boston Scientific. Web.

Crow, D. (2015) Medtronic: the tax inversion that got away. Financial Times. Web.

Deloitte (2018) Medtech and the internet of medical things. Web.

Ebeling, A. (2019) World’s largest healthcare companies 2019: Medtronic, Thermo Fisher, HCA Healthcare on top. Web.

George, W.W. and Baraldi, M. (2017) ‘Medtronic: making the big leap forward (A)’, Harvard Business Review, Web.

Harris, J. (2019) As Olympus unveils corporate strategy, company to cut ‘some IT positions’ in Center Valley. The Morning Call. Web.

Harvard Business Review (2016) Event summary: costs and outcomes in health care. Web.

Harvard Business Review (2017) Value-based health care forum:2017 event summary. Web.

Ho, K.P.L., et al. (2018) ‘Exploring market orientation, innovation, and financial performance in agricultural value chains in emerging economies’, Journal of Innovation & Knowledge, 3(3), pp. 154-163. Web.

Jobber, D. and Ellis-Chadwick, F. (2019) Principles and practices of marketing, 9th edition. Mc-Graw Hill.

Kamboj, S. and Rahman, Z. (2017) ‘Market orientation, marketing capabilities and sustainable innovation: the mediating role of sustainable consumption and competitive advantage’, Management Research Review, 40(6), pp. 698-724. Web.

Kaplan, R.S., et al. (2018) ‘Medtronic: navigating a shifting healthcare landscape’, Harvard Business Review, Web.

Martin, S.L., Javalgi, R.G. and Ciravegna, L. (2020) ‘Marketing capabilities and international new venture performance: the mediation role of marketing communication and the moderation effect of technological turbulence’, Journal of Business Research, 20, pp. 25-37. Web.

Najafi, T.S., Sharifi, H. and Najafi, T.Z. (2016) ‘Market orientation, marketing capability, and new product performance: the moderating role of absorptive capacity’, Journal of Business Research, 69(11), pp. 5059-5064. Web.

Nielsen, C. (2019). Valuation of the company Medtronic. Degree Thesis. Web.

Niero, M. and Rivera, X.C.S. (2018) ‘The role of life cycle sustainability assessment in the implementation of circular economy principles in organizations’, Procedia CIRP, 69, pp. 793-798. Web.

One Olympus Report (2017) Value creation story. Web.

Sanofi (2020) Business model, value creation and value distribution. Web.

Searcy, C. (2016) ‘Measuring enterprise sustainability’, Business Strategy and Environment, 25(2), pp. 120-133.

Scripps National (2020) Medtronic recalls more than 322k insulin pumps tied to 1 death, thousands of injuries. Web.

Taghiporian, M.J. and Bakhsh, M. (2017) ‘Marketing philosophies: from customer abuse to customer intimacy, and again a little customer torment’, Journal of Business Theory and Practice, 5(3), pp. 198-216. Web.

West, A. (2016) ‘Applying methaethical and normative claims of moral relativism to (shareholder and stakeholder) models of corporate governance’, Journal of Business Ethics, 135(2), pp. 199-215. Web.

Appendix A: Detailed Information about Medtronic

Medtronic was founded in 1949 and was initially operating as a shop that repairs medical equipment. The initial expansions were made through the provision of pacemakers during the 1950s after an unusual accident related to Minneapolis-based power outages and overall deficiency of the product in the market. The work on implantable pacemakers further empowered the company to progress further in the direction of developing implantable pacemakers and led to the first competitive rivalry with Boston Scientific in the cardiac rhythm field. Further, during the 1960s and the 1970s the company established new headquarters across the United States and managed to accumulate significant funds to perform the first acquisition in 1998.

Since 2005, Medtronic experiences issues with PETA for accusing the company of inappropriate management of the animal welfare standards, with the first claim to stop experiments described as ‘crude and cruel.’ The company responded by conducting a feasibility study to justify the validity of such accusations and concluded that nans of using animals in medical research are impractical, while acknowledged the need for searching alternative means for business integration. In 2014, the company managed to execute a tax inversion to the Republic of Ireland and move its legal headquarters to a new location while maintaining local operations and therefore enjoy the low corporation tax program provided by the new country.

Eventually, it brought a fruitful opportunity to make strategically important business acquisitions to enhance competitiveness and acquire new strategic authority in the global medical device market. Currently, the company successfully operates in more than 140 countries and employs approximately 100,000 employees, while given the reorientation towards value-based healthcare philosophy and growing needs in medical care might be expected to expand operations further.

Appendix B: Supporting Concepts

The following table lists the marketing concepts that were considered for the analysis of the operational environment, evaluating value creation approaches, and marketing strategy recommendations.