Introduction

Nestle is a multinational corporation that operates in various parts of the world and occupies a significant market share. The long history of leading the food and drink industry has contributed to the company’s strong strategies in business, operational, and corporate domains. Given the multinational, diverse, and complex nature of the company’s operations, a strong corporate strategy is essential for accomplishing business goals and corporate missions. As a leader in the industry of food and beverage, Nestle has built a wide range of businesses that include drinks, nutrition for infants and pets, and meals. Moreover, the corporation has its share in beauty companies, which only diversifies the scope of its enterprise. In order to manage the multiple businesses within one global corporation, the leaders of Nestle adhere to a strategy that allows for gaining competitive advantage, create value for shareholders, and meet customer needs in an efficient manner. The strategies adopted by the corporation allow for using the opportunities for global expansion and business sustainability.

The current paper is aimed at exploring and analysing Nestle’s corporate strategies against the criterion of suitability. The scope of the report is limited by the current and most recent strategies that impact the company at present. First, the paper introduces an overview of Nestle’s history, business strategy, and mission and vision to provide a relevant context for the following discussion. Then, the currently and recently implemented corporate strategies are described using such tools as Porter’s generic strategy and the Boston Consulting Group (BCG) market growth and market share matrix. The evaluation of Nestle’s corporate strategies is carried out by using PESTEL analysis, SWOT analysis, and stakeholder mapping. Overall, the evaluation aims at analysing how the strategies match the company’s environment, capabilities, and stakeholders’ expectations. Ultimately, the paper seeks to provide an informed and evidence-based analysis of Nestle’s corporate strategies.

Background Information on Nestle

The Company’s History

The multinational corporation with its headquarters in Switzerland, has a long history of business development on an international level. Nestle’s history started in 1905 when Henry Nestle’s company for infant food merged with the Anglo-Swiss Condensed Milk Company to form the Nestle Group (Nestle, 2020c). During its first decades of performance, the company owned up to 20 factories and expanded to Asia, Latin America, Asia, and Africa. By the mid-1910-s, Nestle became the world’s largest dairy company with a global market presence. Since then, the scope of the company’s products gradually broadened, as well as multiple mergers, acquisitions, and new businesses occurred. In the 1940-1950-s, Nestle introduces such new and highly competitive brands as Nestea, Nescafe, Nesquick, and Maggi, which successfully occupy the food and beverage markets of the US and Europe (Nestle, 2020c). The strategy for diversification in business became one of the main guidelines of the company’s operations.

Steadily occupying the global leading position in the food industry, the corporation developed its strategic vision for growth, which is the provision of nutrition, health, and wellness. Within this framework, new business branches, such as pet food, ice-cream, and bottled water, were prioritized (Nestle, 2020c). In the 2000-s, Nestle actively acquires such companies around the world as Jenny Craig, Uncle Toby’s, Novartis Medical Nutrition, Gerber, Sources Minerales Henniez, and others, thus expanding its presence in the strategically important markets and industries (Nestle, 2020c). Also, in the early 2010-s, Nestle launches the Nestlé Cocoa Plan and Nescafé Plan to enhance its strategic positions and ensure the sustainability of coffee and cocoa supply. At present, Nestle expands its positions in the industry of infant nutrition and medical products, as well as invests in the development of the skin-care industry and the production of healthy foods. Now the company has approximately 2000 brands and operates in 187 countries of the world, which places it at the leading position in the industry.

Mission, Vision, and Core Values

Nestle posits itself as a corporation driven by the purpose of “enhancing quality of life and contributing to a healthier future,” which is expected to contribute to the society and facilitate business success in the long-term perspective (Nestle, 2020a, para. 1). Aligned with this mission, the company’s vision is based on the enhanced positive impact for people, communities, and the planet, which might be achieved through sustainable operations, environmental strategies, and healthy lifestyle promotion. The company claims to adhere to the same core values that were initially followed by the company founder. They include honesty, integrity, legality, and respect that are thoroughly adhered to in the interaction with consumers and stakeholders.

The Company’s Business Principles

The corporation operates in the field of the beverage and food industry, occupying a dominant market share on a global scale. That is why it is necessary for Nestle to develop and adhere to solid business principles that define its performance priorities and the relationships with its stakeholders. Indeed, the interests of and loyalty with key stakeholders are the top values of the company. Long-term success is defined by Nestle’s management as the central determinant of business accomplishment. According to the company’s statement, acting with commitment and integrity across all brands and businesses in all countries of the world allows for earning the trust of “employees, consumers, customers, suppliers, shareholders and wider society’ (Corporate business principles, 2020, p. 1). Such devotion to building sustainable relations with stakeholders forms the foundation for Nestle’s continuous growth and leading position in the industry. Also, it is based on a long-term perspective, prioritised by decision-makers at all levels of corporate performance.

The company’s mission formulated in the phrase Good food, Good life, entitles its multiple businesses and brands to be led by their commitments to provide quality food for better life opportunities of the customers. Within the framework of this mission, Nestle builds its business principles around the idea of Creating Shared Value (CSV) (Corporate business principles, 2020). The activities and products of the company are aimed at making “a positive difference to society while contributing to Nestlé’s ongoing success” (Corporate business principles, 2020, p. 1). Thus, sustainability and value creation are the cornerstones of Nestle’s business strategy.

Importantly, out of six groups of business principles, the corporation sets forward consumers, employees, and value chain, thus demonstrating its high level of dependence on human capital, corporate culture, and consumer-direction. The other three principles involve business integrity that values ethical and law-abiding conduct, transparent interaction and communication, and compliance with human rights and employment terms, business planning, and performance audit (Corporate business principles, 2020). Another distinctive feature of the way Nestle carries out its business practices is the creation of a uniform code of business conduct that is cultivated in all Nestle’s business and divisions across the globe (Code of business conduct, 2007). In such a manner, all enlisted business principles are consistently complied with through the geography and hierarchy of the multinational company, which forms a solid foundation for developing stable corporate strategies. Overall, applying high standards and strict regulations, Nestle runs its business in a principled way that creates a competitive advantage.

Nestle’s Corporate Level Strategies

Recent and Current Strategies

Due to the status of Nestle as the number one food and beverage multinational corporation in the world, its corporate strategies are characterised by innovative approaches, value-orientation, and sustainability commitment. According to the company’s official website, Nestle adheres to the main strategic principle stating “Good food, Good life” (Nestle, 2020e). The diverse portfolio of products and brands by Nestle requires the company to apply specific corporate strategies that would allow for maintaining this strategic principle across the corporation and allow for the relative independence of each business to be accountable for its own decision-making. Overall, the company is led by “product evolution, innovation, acquisition, or partnerships” to enhance people’s nutrition, health, and wellness (Nestle, 2020e). The execution of these paramount priorities is possible through diversified channels of partnership, supply-chains, scientific support, and other types of collaboration that ensures Nestle’s sustainability.

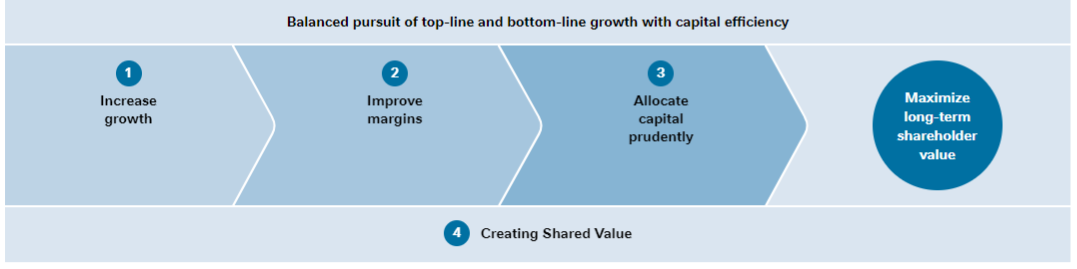

The corporate level strategies of the company are developed around a specific value creation model applied in a long-term perspective. This model “is based on the balanced pursuit of resource efficient top- and bottom-line growth as well as improved capital efficiency” (Nestle, 2020e, para. 6). Thus, the corporate strategies include such three domains, namely increasing growth, improving operational efficiency, and allocating capital and resources reasonably “through acquisitions and divestitures” (Nestle, 2020e, para. 7). The ultimate goal is the creation of shared value and enhancement of long-term shareholder benefits, which is considered to be the basis for the corporation’s growth and sustainability in the competitive market (Figure 1).

The strategy of increasing growth is implemented on the basis of the global dominance of Nestle in its respective field. According to the company’s official data, its portfolio includes approximately two thousand brands which are present in 187 countries (Nestle, 2020e). The revenue from 34 of these brands reaches the point of “CHF 1 billion each in annual sales at retail level” (Nestle, 2020e, para. 9). The company strives to continue growing based on the relevance concerns and the latest consumer trends. From this perspective, Nestle increases its investment in the most high-growth brand categories, which include pet food, nutrition, water, coffee, and nutritional health. These categories constitute up to 59% of all sales of the corporation and continue to grow (Nestle, 2020e). At the same time, the company invests in other brand categories, as well as in such strategically important spheres as e-commerce and digital marketing. To ensure performance excellence across the businesses, the corporation addresses the issues of underperforming sectors and integrates them into units to facilitate their development. Potential acquisitions are continuously monitored, and underperforming businesses are subjected to divestment.

For the purpose of margin improvement, Nestle applies strict efficiency and cost management strategies. Reinvestments are made into innovation, product development, and marketing to ensure that the company moves in the direction of continuous growth. The manufacturing level is continuously optimized to reduce costs and simplify the production processes (Nestle, 2020e). In order to enhance the corporation’s agility, more accountability, risk-taking, and decision-making are allocated to separate businesses. Also, digitalisation of the processes inside the company allows for facilitating the operations through standardisation and automation.

Finally, the strategy of prudent allocation of capital is manifested through investing in long-term advancement. All resources are invested in creating shared value and improving the quality and scope of essential products from the company’s portfolio. By applying strict yet flexible financial policies, Nestle manages to increase “return on invested capital by 20 bps, from 12.1% in 2018 to 12.3% in 2019” (Nestle, 2020e, para. 10). The majority of investments are made into the businesses and products having the highest profit potential. Also, an active acquisition policy is used to invest in the strategically profitable projects. The increase of revenues and the return of cash to shareholders are the priorities of Nestle’s corporate strategies.

Porter’s Generic Strategy Matrix

Any business operating in a highly competitive environment might be characterised by its particular position in the market. According to Porter (1985), the position might be either below the market’s average profitability rate or above it. For a company to maintain its competitive advantage in the long run, it must obtain a position of profitability higher than the industry’s average. In such a case, it will occupy a stable leading position, outperform its main competitors, and ensure its sustainable long-term growth. Since Nestle occupies a leading position in the food and drinks industry on a global scale, it is essential to analyse its competitive strategy using Porter’s approach.

In essence, the Generic Strategy Matrix involves competitive strategies that exist in two dimensions. These dimensions are strategic scope, or the demand side of the market, and strategic strength, or the supply side of the industry in which a company performs (Tanwar, 2013). The three possible strategies that a business might adhere to within these two dimensions are cost leadership, differentiation, and focus strategies (Figure 2).

Figure 2. Porter’s Generic Strategies

Such a subdivision of the strategies is derived from the fact that companies with both high market presence and low market presence usually obtain a sustainable competitive advantage in their respective industry (Tanwar, 2013). As for Nestle, the company’s competitive advantage might be discussed within the context of each of these three generic strategies.

Firstly, the cost leadership strategy is utilised by businesses when their target is to become the firm with the lowest cost in the market. According to Porter (1985), when prioritising cost advantage, it is essential for a firm to occupy a number of related industry segments to ensure the breadth of its presence in the market. When applied to the corporate level strategies of Nestle, the cost leadership strategy appears to be important for the firm and is based on the pursuit of Nestle to reduce costs for consumers in the long-term perspective (Nestle, 2020e). Indeed, the company primarily targets middle-class consumers as its primary customers. This segment is the most numerous, and it is commonly concerned with the price policies, seeking the most reasonable price combined with high quality. The company’s goal, within this perspective, is to create value through long-term cost-efficiency policies that are implemented via the reduction of manufacturing and operational costs, strengthening supply chains, and promotion of brands and products (Nestle, 2020e). Thus, Nestle enhances its market presence by implementing cost leadership strategies to meet the demands and expectations of middle-class buyers.

Secondly, the differentiation strategy is the one that allows a firm to enhance its competitive advantage through positioning its products and services as unique in its industry. Following this generic strategy, a company strives to perform exceptionally “along some dimensions that are widely valued by buyers” (Porter, 1985, p. 14). In the case of Nestle, the corporation integrates the differentiation strategy with cost leadership and uses its brand reputation as a benchmark of product quality. Nutrition and health concerns on the target consumers are Nestle’s main strategic dimensions, within which the firm establishes its unique positioning in the market. High quality and healthy products are the characteristics of Nestle’s portfolio that allow for accumulating a large number of loyal customers across its multiple brands in various geographical locations.

Thirdly, the focus strategy is manifested through cost focus and differentiation focus. Nestle implements it cost focus strategy through positioning itself as a firm providing a product portfolio with the lowest possible prices given the operational conditions and market forces. As for the differentiation focus, Nestle’s core strategy is creating long-term value by providing the best quality products to its consumers by identifying and meeting their demands and continuously changing trends (Nestel, 2020e). The focus strategy is implemented through diverse marketing and promotional interventions, as well as the provision of a broader ranger and higher quality products in comparison with main competitors performing in the market. If competitors underperform in a given segment of the food and beverage industry, Nestle uses it as an opportunity to improve its performance in the strategically important dimensions (Porter, 1985). Also, the acquisition and divestiture business interventions allow for focusing on products with the highest potential rate to meet the market demands.

BCG Market Growth and Market Share Matrix

The analysis of a firm’s corporate level strategies might be effectively carried out by looking closely at the product portfolio presented. Nestle’s portfolio includes more than two thousand brands and incorporates multiple products in such categories as coffee, water, confectionery, pet care, nutrition, frozen foods, ice-cream, dairy, culinary, drinks, cereal, and healthcare nutrition (Nestle, 2020b). Such a rich diversity of brand categories supplying the market with a range of products enhances the company’s market presence. To analyse the scope of products in Nestle’s portfolio, the BCG growth share matrix might be applied.

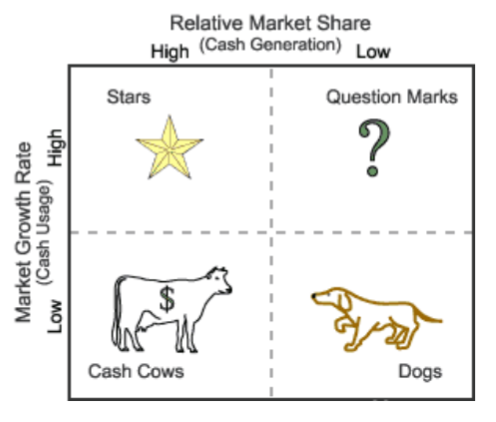

To obtain a competitive advantage and sustain long-term monetary return, a firm must build a coherent strategy of revenue generation and reinvestment. The BCG matrix was generated on the basis of two dimensions, namely growth and market share, on the intersection of which four quadrants of profitability degrees (BCG, 2020). They are symbolically entitled as stars, question marks, cash cows, and dogs (Figure 3).

According to the matrix, the products with high market share and high market growth are considered stars and imply that they are the leading products in the market and present the best business opportunities for the firm. The products with high low market growth and high market share are considered so-called cash cows or the products that, despite the lack of growth potential, enable the company to generate profit (Mohajan, 2017). This cash is then used for investment into stars to promote the leading position in the market.

Question marks are products with high market growth and low market share. Since these products do not generate much cash, it is questionable whether they will become stars or dogs with time. Therefore, the company is encouraged to decide whether to implement such interventions as “market access, market development, or product development” or sell such brands to minimize inefficient resource expenditures (Mohajan, 2017, p. 5). Finally, dogs are the least promising products in terms of their business potential since they are characterized by low market share and low market growth. They do not generate any revenue and are not subject to active investment due to ineffective business strategies. Using these product analysis parameters within the two key market dimensions, a firm is capable of identifying “which markets have the most growth potential” and should be prioritised (BCG, 2020, para. 4). Thus, appropriate actions are to be enforced based on the analysis.

When applying the concept of the BCG matrix to the product portfolio of Nestle, one might generalise that Nestle effectively manages the processes related to its most competitive and revenue-generating brands. This assumption is based on the company’s policies aimed at continuous acquisitions, divestitures, and reinvestments depending on the quality of brands’ performance in the market against customer trends (Nestle, 2020e). Figure 4 demonstrates the BCG matrix for Nestle with the exemplification of the appropriate brand categories representing each quadrant.

Figure 4. Nestle’s BCG Growth Share Matrix

As laid out in Figure 4, Nestle’s products with the highest potential rate are coffee, bottled water, and overall powdered and liquid beverages. The sales analysis indicates that beverages have produced the largest profit and continue growing in terms of market share (Annual review 2019, 2020). Therefore, the company continues to invest in these brands to ensure its competitive advantage. The cash-generating product is Maggi instant noodles, which, despite low market growth, is very popular among buyers and generates significant revenues for the corporation (Gupta, 2019). The capital generated from this product is invested in stars. As for questionable brands and product categories, milk products and confectionary might be considered as question marks due to their unstable position in terms of market share. Finally, ice-cream brands and skin-care are regarded to be underperforming categories of products and are subjected to selling and divestitures (Annual review 2019, 2020). Ultimately, the company adjusts its corporate strategic decision-making according to the performance indicators, market forces, and consumer trends.

Corporate Level Strategies Evaluation

To evaluate Nestle’s corporate strategies against the suitability criterion, one should identify the main dimensions, in which the company operates and which determine its sustainable growth in the long-term perspective. Three areas of strategy analysis might be applied, including environmental analysis, capabilities analysis, and stakeholder analysis. These three perspectives will allow for identifying whether the chosen corporate level strategies comply with the characteristics of multiple environments, its strengths, and weaknesses, as well as the interests and expectations of the key stakeholders. For the purpose of relevant evaluation, PESTEL analysis, SWOT analysis, and stakeholder mapping are applied.

Environment Analysis

PESTEL analysis is a valuable tool that allows for effective evaluation of corporate strategies utilized by a corporation against the criterion of their suitability within a particular environment. Six specifically identified environment types are identified for this analysis due to their essential role in determining a firm’s performance in accordance with its strategies (Babatunde and Adebisi, 2012). They include political, economic, social, technological, environmental, and legal factors (Issa, Chang, and Issa, 2010). Nestle’s performance, according to these factors, influence is particularly important for the evaluation procedure since it allows for defining the dependence of the company’s goal achievement on some external determinants.

From the perspective of political factors, Nestle is highly dependent on the number of restrictions concerning commercial activity, as well as the overall political stability in the regions of the firm’s presence. Overall, the business highly depends on “the political actions of the government, which are capable of changing the expected outcome and value of a given economic entity by altering the probability of achieving business objectives” (Olubodun, I.E. (2019, p. 39). Thus, Nestle’s corporate levels strategies are vulnerable in the face of politically-influenced restrictions, although the corporate policies regarding labour, taxation, and commerce are designed with respect to local governments.

Economic factors are the most influential since they directly impact “profitability and overall attractiveness of a market or industry” (Sammut‐Bonnici and Galea, 2015, p. 2). For Nestle to incorporate the economic environment into its strategy, the firm aligns with the economic situation of a given country, delegates accountabilities to the local management, and accommodates its performance to the opportunities provided by the local economy. Importantly, the criterion of affordability of products plays the most important role.

Social indicators include consumer tastes, preferences, and values that might influence the performance (Sammut‐Bonnici and Galea, 2015). Nestle, as a multinational corporation, ensures that all the stages of manufacturing, delivery, sales, and promotion are executed with the priority of high-quality products to enhance the health and wellbeing of all customers (Nestle, 2019). The company strives to integrate its communication and cultural policies to improve the loyalty of multinational consumers (Dhanesh and Sriramesh, 2018). Technological factors are addressed through well-developed automation policies and investment in e-commerce, which are identified as Nestle’s core goals. Importantly, the changes and advancements in the technological sphere expose the firm to new challenges and expenditures necessary to ensure competitive advantage and cost-efficiency.

An important factor for Nestle is the environment and the opportunities to execute social responsibility to serve the planet. According to Nestle’s statement of commitments, the corporation prioritizes environment-friendly resource utilisation within caring for water, acting on climate change, and safeguarding the environment (Nestle, 2019). Finally, within the framework of the influence of the legal sphere on the business performance of Nestle, one should state that the corporation continuously emphasizes its adherence to the legislature on international and local levels. The terms of commerce, employment issues, hygiene, and quality of products manufacturing, as well as health concerns, are all analysed within the context of particular states.

Capabilities Analysis

The method of the strengths, weaknesses, opportunities, and threats (SWOT) analysis is one of the most valuable tools that allow for identifying strategic opportunities for business. Nestle’s performance in the highly competitive market is characterised by numerous features, the most influential of which are categorised in Figure 5.

Figure 5. Nestle SWOT Analysis

Nestle might be characterised by a high level of market and geographical presence, which are manifested through the operations of Nestle in 187 countries and its leading positioning in the food and beverage industry. At the same time, the diversity of brands, which include approximately two thousand businesses, as well as the history and reputation of the company, all add up to the strengths of the corporation (Nestle, 2019). On the other hand, the weak characteristics include Nestle’s prior drawbacks in brand quality maintenance. As an example, one might present the case of Maggi noodles, which were subjected to banning and testing procedures due to the claims of improper quality and standards violation (Chandran, 2015). Also, the company’s product portfolio implies Nestle’s entering into mature markets where the competition is high (Singh and Alazmi, 2019). In addition, the high level of geographical presence in rural areas and underdeveloped countries exposes the firm to high supply and distribution costs and its sales’ dependence on the operations and cost policies of Target, Walmart, and other hypermarkets.

As for the opportunities for continuous growth, Nestle’s active acquisition and diversification strategy allow it to build new brands and introduce new products to the market. The company is entitled to lowering prices by means of purchasing cheaper raw materials (Singh and Alazmi, 2019). Also, the advantage of global dominance and respected reputation enhances the firm’s opportunities to enter new geographical areas. However, such threats as the potential for new competitors to enter the market and the unstable consumer tastes and purchasing behaviour trends expose Nestle to a possible shortage in sales and unsustainable development. Also, in the light of the latest events connected with the Coronavirus pandemic, the operations of the corporations are highly dependent on the local authorities’ laws and policies related to international sales.

Stakeholder Analysis

When developing a corporate strategy, a business is expected to perform effectively in terms of meeting its key stakeholders’ needs and expectations. In order to identify Nestle’s key stakeholders and analyse the company’s corporate level strategies against the criterion of matching stakeholder expectations, the method of stakeholder mapping is used. According to Sosa (2017), proper stakeholder identification and categorisation are essential in determining the extent to which the firm performs according to the stakeholder expectations and interests. Moreover, the operations and the implementation of the corporate strategies of such large multinational companies as Nestle are significantly impacted by “multi-stakeholder sustainability alliances” (Dentoni and Peterson, 2011, p. 84). Indeed, the multiple stakeholders of Nestle expose the firm to executing multifaceted policies and strategies capable of meeting the demands of key stakeholders.

Nestle manages numerous brands, businesses, and market segments, as well as engages in cooperation with partners, abides by the requirements of investors, and strives to satisfy the customers. According to Nestle’s stakeholder engagement statement, the companies stakeholders are academia, communities, customers, employees, governments, shareholders, reporting agencies, industry associations, and suppliers (Nestle, 2020d). Despite the clear identification of the strategy by the company’s officials, the media claims some significant issues with the strategic approaches utilized by Nestle, which do not comply with stakeholders’ expectations. According to Schroeder (2018), some key investors of Nestle have claimed law levels of revenue return and encourage the firm to improve profitability and capital efficiency. Figure 6 demonstrates the categorization of the stakeholders, depending on the level of their influence and interest.

Figure 6. Nestle’s Stakeholder Interest and Influence Matrix

The upper right quadrant enlists the most influential stakeholders with the highest level of interest in the firm’s successful performance. Investors and suppliers have power over the operations due to their direct engagement in funding and resources provided. The company implements business planning for profitability improvements and supply chain enhancement to comply with the demands of these entities. The lower right quadrant represents the highly influential but insignificantly interested body, which is the governments that regulate the performance of the firm. The upper left quadrant introduces customers, communities, and employees, who have low influence but are highly interested in Nestle’s performance. The company facilitates its strategies to keep these stakeholders satisfied. Finally, the lower left quadrant represents industry associations, reporting agencies, and academia, which are the least influential and interested stakeholders, whose requirements have the least impact on Nestle’s strategic decision-making.

Conclusion

As the analysis and evaluation of Nestle’s corporate level strategies demonstrate, the company effectively applies strategic planning and decision-making to address the multiple forces of a highly competitive market and ensure sustainable growth. As the leader in the industry of food and drinks, Nestle has developed a robust set of corporate strategies built on the mission, vision, core values, and stakeholder obligations. The company’s mission is to provide good food and enhance good life for its consumers. Therefore, the two thousand brands operating in 187 countries comply with the main four strategic priorities, increasing growth, improving margins, allocating capital prudently, and creating shared value. The commitment or shareholders and communities is the core of creating shared value principle.

Nestle utilises the combination of cost leadership, differentiation, and focus strategies to ensure its high market presence, unique positioning among competitors, and focus on value creation for sustainable competitive advantage. The firm applies relevant and timely decisions to the products and brands that perform well or underperform in terms of market share and market growth. Acquisitions, reinvestments, and divestments are executed to adjust the performance to the market processes. The evaluation of Nestle’s performance from the perspective of its suitability to environments shows that the company effectively incorporates the influence of all determinants to facilitate its performance in various environments. The SWOT analysis indicates that Nestle uses its strengths and opportunities to mitigate the impact of threats and eliminate weaknesses. Finally, compliance with key stakeholders’ interests allows Nestle to maintain its sustainable growth.

Reference List

Annual review 2019 (2020) Web.

Babatunde, B.O. and Adebisi, A.O. (2012) Strategic environmental scanning and organization performance in a competitive business environment. Economic Insights-Trends & Challenges, 64(1), pp. 24-34.

BCG (2020) What is the growth share matrix? Web.

Chandran, A. (2015) ‘After the ban, what can help Maggi regain its brand value’, Financial Express. Web.

Code of business conduct (2007) Web.

Corporate business principles (2020) Web.

Dentoni, D. and Peterson, H.C. (2011) ‘Multi-stakeholder sustainability alliances in agri-food chains: A framework for multi-disciplinary research’, International Food and Agribusiness Management Review, 14, pp.83-108.

Dhanesh, G.S. and Sriramesh, K. (2018) ‘Culture and crisis communication: Nestle India’s Maggi noodles case’, Journal of International Management, 24(3), pp.204-214.

Gupta, P. (2019) ‘Maggi, KitKat, Munch yet again Nestle’s profit drivers; continue winning streak of previous quarter’, Financial Express. Web.

Issa, T., Chang, V. and Issa, T. (2010) ‘Sustainable business strategies and PESTEL framework’, GSTF International Journal on Computing, 1(1), pp.73-80.

Mohajan, H. (2017) ‘An analysis on BCG Growth sharing matrix’, Noble International Journal of Business and Management Research, 2(1), pp. 1-6

Nestle (2020a) About us. Web.

Nestle (2020b) Our brands. Web.

Nestle (2020c) The Nestlé company history. Web.

Nestle (2020d) Stakeholder engagement. Web.

Nestle (2020e) Strategy. Web.

Nestle. Creating shared value and meeting our commitments: Progress report 2019. Web.

Olubodun, I.E. (2019) ‘Influence of political environment on firms’ corporate performance: Evidence from selected manufacturing firms in Oyo State, Nigeria’, International Journal of Management and Marketing Research, 12(1), pp.37-50.

Porter, M. E. (1985) Competitive advantage: Creating and sustaining superior performance. New York: The Free Press.

Sammut‐Bonnici, T. and Galea, D. (2015) ‘PEST Analysis’, Wiley Encyclopedia of Management, pp.1-7.

Schroeder, E. (2018) Nestle corporate strategy called into question by investor. Web.

Singh, A. and Alazmi, F.K. (2019) ‘A case study on Nestle’, Journal of International Conference Proceedings, 2(2), pp. 80-85.

Sosa, N.A. (2017) Toward a contingency theory of stakeholder relevance and the stakeholder mapping process. PhD Thesis. Angelo State University. Web.

Tanwar, R. (2013) ‘Porter’s generic competitive strategies’, Journal of Business and Management, 15(1), pp.11-17.