Introduction

The most prolonged and worst economic depression in modern history occurred in the U.S. The great depression quickly extended to the rest of the world. It began in the summer of 1929 as an ordinary recession and lasted until about 1939. Shortly after the ‘roaring twenties, the United States experienced a surge in economic growth and widespread luxury, driven by recovery from wartime funding and deferred spending, fast development of consumer goods, and an increase in construction. During this period, the United States economy moved from wartime to a peaceful economy (Zeitz). This paper discusses the leading causes of depression and the significant events that caused the United States to emerge from that severe economic contraction.

Factors that Caused the Great Depression

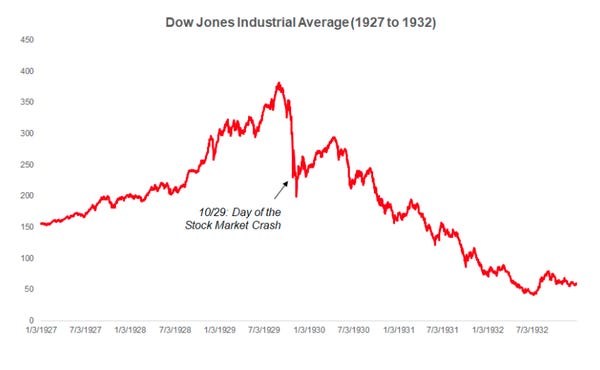

A myriad of factors caused the Great Depression. Still, majorly, it was caused by the following five elements: Firstly, the stock market crash in October 1929 broke investors and the general public confidence towards the U.S. economy. This resulted in a steep decrease in investment and spending. Although this was not enough, the stock market tried to recover some of its losses as the damage was already done. The figure below shows the stock market crash of 1929 after the roaring twenties.

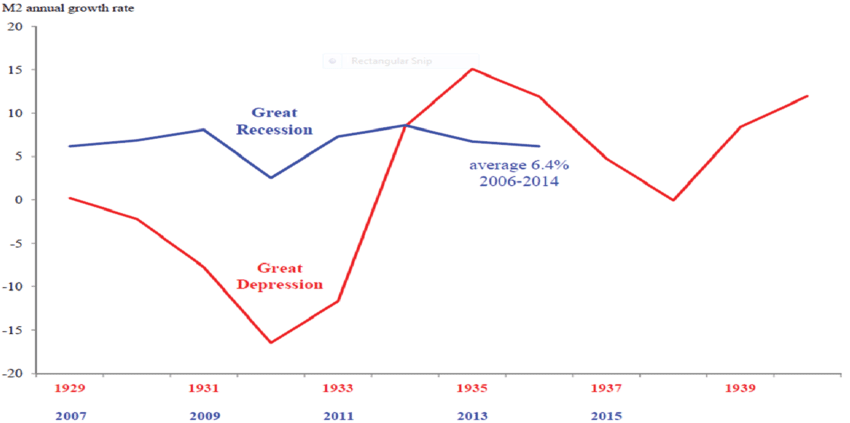

Another essential factor to note is the failure of the federal reserves. According to a study by Coleman et al. 1-2, the money in circulation fell by a third between 1929 and 1933. In 1929, scared businesses and households were holding the cash leading to the depression. As a result, the federal reserve failed to increase the supply of money in the banks. This led to banks and other financial institutions freezing and not giving out credit to the customers. Furthermore, more scared investors withdrew their money from the banks. Banks stopped lending, which caused the economy to contract, pushing the country into severe depression.

The United States used the gold standard as a monetary system during the 1920s (Caton 386). The gold standard is where the country’s currency was being traded for gold. It is important to note that when a country’s currency is on the gold standard, it can’t increase the circulating money without raising its gold reserves. As a result of bank failures, citizens decided to hoard gold, resulting in less money circulating the economy. This set into a motions chain of events that led to the great depression.

The Smoot-Hawley Tariff Act (1930) added considerable strain to the economy (Khan). This act protected the American farmers by adding import duties. The passing of the action by the Senate more or less coincided with the Great Depression. This is because it raised the prices of imports to the point that they became affordable to only the wealthy. This significantly reduced the amount of exported goods, thus contributing to bank failures, majorly in areas that relied on farming.

The citizens had higher household debt due to lower interest borrowing rates and installments credit. Spending during this time increased faster than earnings. Citizens failed to pay outstanding bank debts because of unemployment as incomes fell; this made banks failures to snowball. Cases of loan defaults made the remaining banks to be more conservative in their lending. In turn, the recession worsened, as many Americans found themselves in debt deflation. The rise of loan defaults and bank insolvencies pushed the recession into a depression.

Major Events that Led to the Economic Surge after the Great Depression

The significant events that caused the United States to emerge from the economic contraction include: Desertion of the gold standard and the devaluation of the currency made the country increase their money spending and money in circulation, which increased expenditure, loaning, and investment. In 1939, the United States joined World War II after the attack on Pearl Harbor (Coleman et al. 1-2). Other countries like Britain and France bought enormous supplies to the war from the U.S. This had a dramatic effect on the U.S economy as factories opened and job hirings started. This, in turn, reduced the high rates of unemployment rates experienced during the great depression.

Fiscal expansion by the government on employment, healthcare, and other programs, including the New Deal that helped recovery in the U.S, inspired invention by raising the cumulative demand, which caused a shift from the great depression. The investment into social programs created jobs for the unemployed population, giving them an income that they would have otherwise not received. This, in turn, increased money circulation in the economy.

The difference between recession and depression is that recession declines economic activity distributed across the economy for a few months. However, depression is a more extreme downturn in the financial. It has occurred only once in the United States history. Depression can last for more than the years leading to the decline of the GDP. Depression is not characterized as an economic word because it exaggerates the severe slump in the economy.

Conclusion

Depression can lead to people losing their jobs, homes, and other possessions. It suffices to remark that during the great depression of 1929, almost half of the American banks and other financial institutions were closed. As a result, the gap between the rich and the poor was drastically increasing. This meant that most of the population could not afford basic amenities for survival. The great depression was, however, a learning period for the U.S. as they have since been able to come up with favorable fiscal policies and programs that have ultimately made their economy the most prominent in the world.

Works Cited

Caton, James. “The evolution of Hayek’s thought on gold and monetary standards.” Southern Economic Journal 87.1 (2020): 386-405.

Coleman, Thomas S. “Milton Friedman, Anna Schwartz, and A Monetary History of the U.S.” University of Chicago (2019): 1.

Khan, Sabithulla. Smoot-Hawley: Lessons From the Most Infamous U.S. Tariff Act. SAGE Publications: SAGE Business Cases Originals, 2019.

Zeitz, Joshua. “The Roaring Twenties.” The Gilder Lahrman Institute of American History (2017).