In a real sense, investing involves the “exchange of money at a given time so as to achieve future cash flows from the investment” (Sherrick, Ellinger and Lins, 2000). Changes in time between inflows and outflows with reference to investment conditions cause differences in current values. This implies that assessing investment may be a complex process given inflows and outflows, which occur at different times. Thus, the issues of time and value are crucial when making future investment decisions (Garger, 2010).

There are many reasons why “money received immediately is worth more than money received later” (Garger, 2010). First, positive rates of inflation “lower the purchasing of power of money over time” (Sherrick, Ellinger and Lins, 2000). Second, opportunity costs of lost earnings make money “worth more today than in the future” (Sherrick, Ellinger and Lins, 2000). In other words, we can invest money immediately and realize its returns in the future. Third, there are uncertainties in investments. Thus, any future value of an investment may only remain a promise. Uncertainties may include non-performing investments or risks of default. Fourth, people prefer immediate consumption over future consumption.

Investments attract interest rate. This is the return money earns over time. They compensate investors for “opportunity costs lost” (Garger, 2010). Thus, any investment relies on the interest rate for offsetting the above factors, which explain the worth of money today than in the future.

Thus, information on time and the value of investment can help investors make meaningful investment decisions. However, we must consider other factors like the “length of investment, financing conditions, tax implications, size of the investment, and the feasibility of the investment decision” (Sherrick, Ellinger and Lins, 2000). Therefore, in order to understand the Time Value of Money concept, we must consider cash flows and common values at a given time using appropriate financial techniques.

There are several issues relating to Time Value of Money and investment. First, we have to understand the direction in time that influences conversion of returns to equivalent values. Second, we must also establish whether there is a single phase of return or a series of returns. Finally, we have to comprehend the unknown or variable values of investments. These processes require knowledge of compounding and discounting. Compound entails conversion of the current value to its equivalent value in the future for comparison whereas discounting involves “moving back through time” i.e. converting cash flow received in the future into its equivalent present value (Sherrick, Ellinger and Lins, 2000). Investors must also consider the type of cash flow (a single payment or installments) expected after investments.

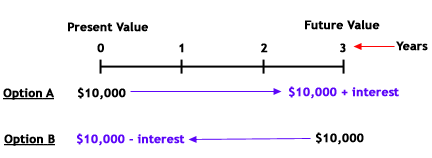

Time Value of Money focuses on “the present value of money and the sum of its future value” (Hanson, Lessley and Johnson, 1991). Immediate payment represents the present value of money whereas the future value includes the principal and its interest over a given period. The interest covers the opportunity lost to earn returns if an investor invests the money today. The future value represents the cash value of investment at a given time in the future.

Future Value Basics

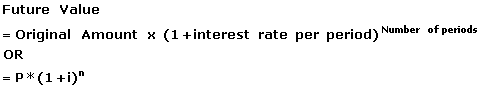

Immediate investment of money at a given interest rate will give the investor interests at the end of the investment period. We can multiply the rate of interest by the sum and add the principal amount. For instance, $10,000 at the rate of 4.5% per annum will give as the following sum.

This is the formula for getting the future value.

Present Value Basics

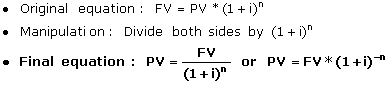

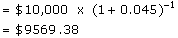

The present value of ten thousand dollars paid after one year will be less than the same amount today. We must determine the sum to invest today so as to get $10,000 in the future. This implies that we must deduct the earned interest from $10,000. We have to discount the future payment by a given interest rate over a given period.

We have to discount the payment backwards in order to determine its future value.

Future and present values of money are useful in capital budgeting (Ehrhardt and Brigham, 2010). Investors must understand how to invest money given its time significance. Any invested money has opportunity costs to the investor until it pays off. Time Value of Money enables investors to understand opportunity costs in making capital budgeting decisions.

The concept of Time Value of Money shows how time is significant when making an investment decision. The value of a dollar we possess today shall not remain the same in the future. Investors must also consider other factors like interest rates, tax systems, time, and the amount for investment. In addition, there are also positive inflation rates and defaults, which may affect the future returns of the investment. This is a complex process. However, investors must consider how time shall influence their assets and returns in the future. This implies that investors must take risks when making investments. Most investors neglect the importance of Time Value of Money concept when making decisions. However, investors should take into account the element of time when making decisions (Hanson, Lessley and Johnson, 1991).

References

Ehrhardt, M. and Brigham, E. (2010). Corporate Finance: A Focused Approach (4th ed.). Thomson: South-Western Publishing Co.

Garger, J. (2010). Financial Markets and the Principle of the Time Value of Money. Bright Hub, 11, 1-2.

Hanson, J., Lessley, B. and Johnson, D. (1991). Analyzing Investment Opportunities: The Time Vlaue of Money in Frm Decision-making. Maryland Cooperative Extension: Fact Sheet 543, 1-6.

Sherrick, B., Ellinger, P. and Lins, D. (2000). Time Value of Money and Investment Analysis. FAST, 1(2), 1-7.