The chosen research topic is the impact of corporate governance on firm performance. This topic was chosen because of the increased interests that have been expressed towards corporate governance. Due to the fall of businesses in 2008 and the prevalent business scandals, corporate governance has become an important organizational aspect.

Abstract

This research study focuses on the effect of corporate governance on organizational performance. In essence, it seeks to determine whether some of the aspects of corporate governance can affect the performance of the firm financially, socially, and in terms of regulations. In particular, it considers the alignment of stakeholders’ interests and sets out to determine whether this aspect affects the performance of the firm. After interviewing the respondents, it was indicated that corporate governance has a crucial effect on the performance of a firm. In essence, corporate governance helps to align the interests of stakeholders by setting specific goals, using a hierarchical administration and offering incentives. In turn, the alignment of the stakeholders’ interests increases teamwork, encourages collaboration and reduces conflict. These three aspects are crucial since they increase the performance of the firm financially, socially and in terms of regulations.

Keywords: Stakeholders, corporate governance, alignment of interests, organizational performance.

Background of the Study

In a nutshell, this research seeks to discuss how corporate governance affects firm performance with a special focus on the alignment of stakeholders’ interests. Essentially, corporate governance is the process by which the organization allocates different responsibilities and provides them with varying rights to facilitate daily operations (Aguilera & Jackson 2003). An organization has various stakeholders, including the managers, employees, creditors, customers, and shareholders among others (Augustine 2009). It incorporates the mechanisms that enable the members to set objectives and pursue them (Bairathi 2009). Importantly, it facilitates the pursuance of these objectives in terms of social, economic and regulatory aspects (Brennan & Solomon 2008). In addition, it provides the framework which enables the evaluation of actions and regulations to inform decision-making in corporations (Brickley, Coles & Jarrell 1997).

Organizations have increasingly accepted the importance of corporate governance in order to ensure efficiency and accountability (Cho & Kim 2007). Since the fatal period in which many companies went down and became bankrupt, corporations have appreciated the importance to monitor actions and policies on real-time basis (Chugh, Meador & Meador 2010). The insolvency of these companies happened due to the accounting frauds, conflict of interests, and lack of futuristic planning (Coles, McWilliams & Sen 2001). In that light, therefore, corporate governance has been seen as the only tool that can restore the dignity and reliability of the organizations (Core, Holthausen & Larcker 1999). This research paper seeks to discuss how the governance affects the performance of firms. Specifically, it seeks to emphasize on the alignment of stakeholders interests in order to attain the organizational objectives. This is based on the fact that aligning stakeholders’ interests present one of the greatest challenges to administrators (Ehikioya 2009).

Focus of the Study

Corporate governance is a broad concept that includes aspects such as decision-making, implementation of policies, and alignment of stakeholders’ interests, as well as the crafting of regulations (Finkelstein & Aveni 1994). However, this study was limited to a specific area of study in order to make helpful determinations. The study sought to determine the effects of organizational corporate governance on the alignment of stakeholders’ interest which is an important factor when it comes to performance.

Research Problem

From a critical point of view, an organization comprises of many individuals and categories of stakeholders (Islam, Bhattacharjee & Islam 2009). These categories of stakeholders have differing interests in the organization (Khanchel 2007). For example, the shareholders are concerned with dividends while the employees value their salary compensation. As a result, the shareholders struggle to increase the dividends per share while the employees work hard to add their salaries (Laporta et al. 1999). On the other hand too, the managers focus on the productivity and the orderliness of the employees to increase productivity. In such a setup, it is evident that the organizational stakeholders have diverse interests that can affect the organization if they are not aligned. The lack of alignment prevents the cohesiveness of the organization and collaboration (Majumdar & Chhibber 1999). As such, it reduces the performance of the firm financially due to the lack of goal-oriented operations. The research, therefore, seeks to determine ways in which corporate governance aligns the different interests of the organizational stakeholders in order to facilitate good firm performance.

Research Rationale

In essence, the alignment of stakeholders has been regarded as the most challenging aspect of corporate governance (Rajagopalan & Zhang 2009). This is caused by the fact that different organizational members have diverse inherent interests that inform their affiliation to the organization. Due to this condition, it becomes difficult to align the individual interests to achieve a common organizational goal (Rashid et al. 2010). It is, therefore, rational to research on the way in which corporate governance aligns these diverse interests and how this pursuit affects performance.

Aims and Objectives

Denscombe (2009) indicated that a research aim is a general focus of the research while the objectives are subsets of the latter. The objectives are the specific accomplishments that help to achieve the main aim of the research (Flick 2009.

Aim

Evidently, the aim of this research is to investigate the effect of corporate governance on the organizational performance. This is achieved through two distinct objectives as shown in the list of objectives.

Objectives

- To determine how corporate governance is used to align differing stakeholders’ interests.

- To determine the manner in which the alignment of members’ interests affects the performance of a firm.

- To determine whether there is correlation between corporate governance and financial performance.

Research Questions

- How is corporate governance used to align differing stakeholders’ interests?

- How does the alignment of the stakeholders’ interests affect the performance of the organization?

- Is there correlation between corporate governance and financial performance of a firm?

Research Hypotheses

- Corporate governance sets evaluation systems that assess the performance of organizational stakeholders in relation to the set objectives in order to eliminate the effect of individual interests.

- Corporate governance has a positive effect on the performance of the firm.

Literature Review

Corporate Governance

Treadwell (2006) defined corporate governance as the process by which an organization allocates different responsibilities and provides them with varying rights to facilitate daily operations. The author acknowledged that an organization comprises of many stakeholders with different perspectives and individual aspirations. As such, Vafeas and Theodorou (1998) indicated that corporate governance must include the alignment of stakeholders’ objectives with those ones of the organization. The authors acknowledged that the alignment of stakeholders’ goals with those ones of the organization poses the greatest challenge to the CEOs.

A similar statement was made by Weill (2003) where he indicated that alignment of organizational and individual interests is essentially difficult but possible. Although the author aimed at showing the optimistic bent of the interests’ alignment, he appreciated that the undertaking is quite involving. In that regard, therefore, the alignment of members’ individual interests with the organizational interests is critical component of the corporate governance. From a critical point of view, it is sufficient to investigate how it affects the social and financial performance of the organization.

Alignment of stakeholders’ Interests

Alignment of stakeholders’ interests allows the corporate administrators to identify a common point of focus. Understandably, all the stakeholders have different ambitions for their individual prosperity because everyone starts business to make profits. Importantly, the managers and shareholders have very differing interests in the organization. Mostly, the managers have the clamor to increase the capital base, assets and profits. On the other hand, the shareholders fight for high-interest rates in order to get increased payout in the form of dividends. As such, the alignment of stakeholder’s interests is meant to reconcile the ambition of the managers, as well as the shareholder. In this way, the two shareholders can work towards a common goal and strike a balance between them.

Interests Alignment and Firm Performance

In a research conducted by Chen, Lai and Chen (2012), it was indicated that corporate governance has critical effects on the performance of an organization. The authors investigated the relationship between some aspects of the corporate governance and the firm’s performance. In this case, they stated that the size of the board in an organization creates a high possibility of economic performance of the organization.

In another research conducted by Sorensen (2007), it was argued that a high number of board members enable them to tap more chances in the market and woo customers in an organization. This is based on the fact that board members are expected to use their individual influence in order to bring some opportunities in the organization and increase income. However, a different research study indicated that the number of autonomous board of governors can lead to negative effects on the organizational financial performance.

In this case, it is indicated that the excessive number of these independent directors lower the performance due to the conflicting ideologies yet they are not supervised directly. This situation might also prevent the CEO from making critical decision in the direction that favors the company’s financial position. As such, it becomes important to reduce this number of autonomous board of directors.

Siagian & Tresnaningsih (2011) conducted a similar research concerning the effect of corporate governance on the organizational performance. In this case, the authors indicated that the board of directors has a critical influence on the operation of the organization and its output. However, they did not concentrate on the size of the board as a crucial factor of performance. Instead, they addressed the components of the board and how it can affect the performance. In particular, they revealed that a diversified board of directors is more effective than one which has people of the same specialization or character.

For example, boards that contain risk takers and risk avoiders are expected to perform better than a uniform one. The authors argued that the presence of diversity becomes important when making decisions. As such, the board needs to look at decision making from different perspectives in order to make a helpful compromise. The authors further explained that if all the members of the board were risk takers, they might take more risk than the organization can bear. On the other hand, risk avoiders cannot make significant profits in business since the low-risk investments are not very profitable.

Data and Methodology

Research Strategy

Yin (2009) indicated that there are different strategies that can be used to conduct a research study according to the nature of the study. As such, he stated that these research strategies included experiments, surveys, and case studies among others (Creswell 2009). Indeed, this research mainly took the form of a research survey based on the fact that online questionnaires were used to collect the needed data. In this case, it was the most appropriate way of obtaining first-hand information from the CEOs, managers and employees concerning the use of corporate governance, alignment of stakeholders’ interests and the firm performance.

Sources of Data

This research depended on both secondary and primary data in order to obtain reliable results. The primary data was obtained from the relevant population, including managers, directors and organizational employees as described in paragraph 3.3. The review of secondary materials forms the basis for identifying the findings of the previous studies conducted by other authors. This review of previous studies indicated the gap that should be filled by this research and also acted as a prerequisite for the study. On the other hand, primary research provided data needed to close the gap. In particular, the respondents were needed to provide information about the use of corporate governance to align stakeholders’ interests and improve the organizational performance.

Time Schedule and Frequency

Population

In essence, the population refers to the set of respondents who provide data for the analysis and subsequent conclusion (Sachdeva 2009). As such, the relevant population for this research is quite extensive. It includes several categories of personnel including chief executive officers, shareholders, employees, shareholders, and managers among others.

However, due to the nature of the research, the research includes three segments including chief executive officers, managers, and employees. Chief executive officers and managers were expected to provide information on how their corporate directives affect the output of the organization.

Sample Size and Sampling

Understandably, the potential population for this research is very big due to the inclusion of three segments of personnel that include the employees, chief executive officers, and manages. When the population is too big, it becomes important to select a number of individuals to provide data for the research analysis (Collis & Hussey 2009). The selection was conducted using the random sampling method. This incorporates two sampling techniques including random and purposeful methods (Northouse 2010). Random sampling ensures the respondents are selected in a manner to obtain predetermined and biased results (McBurney & White 2010).

On the other hand purposeful sampling facilitates the selection of respondents who have the relevant information for the research study (Marshall, C & Rossman 2011). Based on purposeful sampling, all respondents must have worked for at least three years. This ensures that the respondents have deep and reliable information concerning the use of corporate governance, alignment of stakeholders’ interests and the organizational performance. As such, the inclusion of randomness to avoid biases and purposefulness to ensure reliability of data improved the credibility of the entire research.

In regard to size, 133 respondents were selected for the data collection venture through interviews. With regards to segmentation, 26 of them were chief executive officers, 42 acted as managers, and 65 respondents were employees. However, only 87 of the sampled individuals responded to the online survey we had sent to their emails. In that light, therefore, it is evident that the research had to rely on the 87 respondents who filled the online surveys. Indeed, it was reliable because it accounted for about 70 percent of the targeted sample size. Indeed, it was not expected to affect the intended reliability of the data negatively.

Variables

There are various variables that are considered in this research for the sake of analysis. The first variable is the firm performance which is the dependent variable in accordance to the research setting. In the first chapter, it was indicated that the research investigates the effect of corporate governance on the firm’s performance. As such, the firm performance is indeed the dependent variable. On the other hand, there is the alignment of the stakeholders’ interest. This is the independent variable since it is expected to influence the firm performance.

Theoretical Models

Theory of Positivism

This research is consistent with the law of positivism that advocates the use of mathematical calculations in the process of making determinations. It argues that credible knowledge can be obtained from quantitative methods only. In essence, it invalidates the use of qualitative methods in the analysis and collection of data. It faults the use of intuitive knowledge and states that all data points can be expressed in some mathematical forms. In that regard, Liamputtong (2009) indicated that the theory implies that all societal behavior act according to realistic general laws of nature. However, it is not in order to make the assumption that all information can be expressed mathematically (Berg 2009).

Theory of Interpretivism

The theory of interpretivism allows the use of qualitative methods during the analysis of data that cannot be expressed quantitatively (Jha 2008). The theory is a perfect contravention of the principle of positivism. Although it remains neutral about the use of mathematical computations in research, it asserts that reality is multidimensional. This implies that reality can be viewed in terms of quantitative and qualitative perspectives. This implies that reality in the society does not rely on the application of quantitative methods and aspects. It contends that a researcher cannot concentrate on empirical analysis and disregard other dynamics of the social system that affect the society. It allows the use of value-laden information to make reliable and credible conclusions. The inclusion of both theories in the research study was of critical importance since it allowed the use of mixed methodology.

Methodological Justification

The use of both secondary and primary sources of data was a rational strategy of conducting a holistic research study. In this case, the secondary research provided information concerning the major findings on the topic by other authors. At the same time, the analysis of the secondary findings formed the basis for identifying the research gap that should be closed. As such, secondary research was the foundation for this research. The primary research was critical to the entire research since it helped to obtain data for the identified gap. This implies that the combination of the two types of researches was not only effective but also necessary to the study.

The sampling was also conducted in a unique and effective manner especially to remove biases and increase credibility of the research. In this light, the use of random purposeful sampling allowed the combination of two sampling methods. The random part enabled the selection of sample impartially rather than aspiring to obtain predetermined results. The purposefulness ensured that all respondents would have the needed information. As a result, they were required to have three years experience in their areas of specialization.

The inclusion of the three segments of the population was a critical aspect when it came to data reliability. In essence, including the CEOs, managers, and employees provided a good basis for obtaining two-ended information since the managers and CEOs are the custodians of corporate governance while employees are the subjects. Bairathi (2009) indicated that there is

Possible Limitations

There are several limitations to this research that can affect the findings of the research study at the end. First, the use of quantitative methods calls for the identification of quantifiable variables for mathematical computations. However, some of the variables such as alignment of stakeholder’s goals are entirely qualitative.

On the other hand, the firm performance can be expressed in quantitative and qualitative terms. As such, the research has variables that are partly quantifiable while the others are not. This presents a situation in which the research becomes more qualitative rather than quantitative.

Results

Analysis

Discussion

Research Question 1: How is corporate governance used to align differing stakeholders’ interests?

According to the responses provided by the sample, the research suggested three crucial ways in which corporate governance align stakeholders’ interests in the organization. First, it was indicated that the allocation of responsibilities to the organizational members is one of the most effective ways of ensuring the alignment of interests in the organizations. Most importantly, the employees and managers are assigned specific roles which form the basis of the performance evaluation. As such, these responsibilities are set in a manner to help in achieving the set organizational objectives. With all the employees allocated their responsibilities, the organization manages to provide direct their actions and ensures they are consistent with the obligations of the company. In addition, it reduces the conflict between members when it comes to the actual implementation of organizational plans.

The second technique used to align the stakeholders’ interests is providing a clear goal setting framework. In this case, the organization should ensure that it has realistic and measurable objectives. In addition, all the stakeholders should be informed about the mission and objectives of the organization. In this way, the stakeholders get clear information about what is expected of them. As such, there is a very high likelihood for the organizational members to work towards a common objective and sacrifice their personal interests for the sake of the organization. However, this sacrifice cannot be achieved by stipulating the objectives and making the public to the members of the organization. Instead, the organization administrators need to inculcate the spirit of commitment among the members.

In accordance with this research, it was indicated that the provision of incentives that resonate with personal ambitions can help to align the ambitions. For example, it is possible to increase the salaries of employees or offering promotions once they perform extemporarily according to the stipulated objectives of the organization. In addition, it was indicated that the employees should also set goals at a personal level in order to contribute to the common organizational objective. These goals should be shared with their managers and become the framework for making progress.

Besides the stipulation of goals, it was indicated that an effective chain of command was crucial to the process of achieving the common organizational objective and ensure high performance. The hierarchical chain of command ensures that the members are supervised and directed towards the objective. In this case, it is evident some members might choose to go against the frameworks of the organization. As such, a chain of command ensures that these elements are regulated and their actions are monitored. Importantly, the respondents indicated that the alignment of organizational interests is capable of increasing the financial performance.

Research Question 2: How does the alignment of the stakeholders’ interests affect the performance of the organization?

With regard to the second research question, there are various ways in which the alignment of stakeholders’ interests affects the performance of the organization. First, it was discovered that the alignment reduces the conflict among the members of the organization. This ensures that all the stakeholders pay attention to the common goal and abandon individual conflicts. Second, the alignment improves the working relationship between stakeholders. As such, the good working relationship enables them to work harmoniously and encourages teamwork. The teamwork approach builds collaboration and hence increases the financial performance of the organization.

Research Question 3: Is there correlation between corporate governance and financial performance of a firm?

In order to answer this question, financial ratios were obtained from the Morning Star website. In particular, the Turnover Asset ratio was considered as the reflection of corporate governance. This is based on the fact that Asset Turnover Ratio (ATR) shows how efficiently the resources have been used. In turn, the use of resources was indicated as one of the functions of corporate governance. On the other hand, the Gross Margin Ratio (GMR) was used as an indicator of profitability. As such, Walmart and Exxon Mobil were used as samples since they are some of the most reputable companies in the globe.

Company I. Wal-Mart Analysis

Regression

Correlations

According to the analysis of correlation, it is evident that there is a very high but negative correlation between corporate governance and profitability of the company as far as Wal-Mart is concerned. This implies that an increase in the Asset Turnover Ratio leads to decrease profitability. This implies that the cost of replacing inventory is higher than the revenue the commodities earn. As such, corporate governance has an effect to the profitability of the company.

Company II. Exxon Mobil

Regression

Correlations

There is a very high positive correlation between the Asset turnover ratio and the Gross Margin Ratio. This implies there is a direct effect between corporate governance and the profitability of the company.

Company III: Chevron

Regression

Correlations

Company IV: Apple

Regression

Correlations

Company V: Ford

Regression

Correlations

It is evident that four companies either register a high negative or positive correlation between the efficient use of resources and the profitability. This implies there is a very strong correlation between companies’ corporate governance and the financial performance of the company.

Conclusion

It is evident that there is a relationship between corporate governance and the firm’s performance. In particular, the alignment of stakeholders’ interests, which is one of the most critical undertakings of corporate governance, reduces the conflict among the members and increase collaboration among them. As such, it encourages teamwork and hence the output of the members is increased extensively. In addition, it facilitates the stipulation of common objectives for the organization. These goals become the guiding principles of operation and the basis of performance evaluation.

When it came to the question of how corporate governance aligns the interests, it was evident that the allocation of roles helps to confine the personnel to the organization commitment. In addition to the allocation of roles, hierarchical chain of command is a critical component when it comes to aligning the members’ interests. It ensures that all individuals are supervised on real-time, directed and guided to align their goals to those of the organization. However, incentives are also important to ensure that the members are motivated to work for the organization diligently.

References

Aguilera, R & Jackson, G 2003, “The cross-national diversity of corporate governance: Dimensions and determinants”, The Academy of Management Review, vol.9, no. 10, pp. 447-465.

Augustine, C 2009, Improving school leadership the promise of cohesive leadership systems, RAND, Santa Monica, CA.

Bairathi, V 2009, “Corporate governance: A suggestive code”, International Research Journal, vol. 11, no. 6, pp. 753-754.

Berg, B 2009, Qualitative research methods for the social sciences (7th ed.), Allyn & Bacon, Boston.

Brennan, N & Solomon, J 2008, “Corporate governance, accountability and mechanisms of accountability: an overview”, Accounting, Auditing & Accountability Journal, vol. 21, no. 7, pp. 885-906.

Brickley, J Coles, J, & Jarrell, G 1997, “Leadership structure: Separating the CEO and chairman of the board”, Journal of corporate Finance, vol. 3, no. 3, pp. 189-220.

Chen, I, Lai, J, & Chen, C 2012, “Industrial Concentration, Innovation and Corporate Layoff Announcements”, International Research Journal of Finance and Economics, vol. 12, no.2, pp. 87.

Cho, D & Kim, J 2007, “Outside directors, ownership structure and firm profitability in Korea”, Corporate Governance: An International Review, vol. 15, no. 2, pp. 239-250.

Chugh, L, Meador, J & Meador, M 2010, “Corporate Governance and Firm Performance.” Journal of Business and Economics Research, vol. 8, no. 9, pp. 1-11

Coles, J, McWilliams, V, & Sen, N 2001, “An examination of the relationship of governance mechanisms to performance”, Journal of Management, vol. 27, no. 1, pp. 23-50

Collis, J & Hussey, R 2009, Business research: a practical guide for undergraduate & postgraduate students (3rd ed.), Palgrave Macmillan, Basingstoke.

Core, J, Holthausen, R & Larcker, D 1999, “Corporate governance, chief executive officer compensation, and firm performance”, Journal of financial economics, vol. 51, no. 3, pp. 371-406.

Creswell, J 2009, Research design: qualitative, quantitative, and mixed methods approaches, Sage, Los Angeles.

Denscombe, M 2009, Ground Rules for Social Research Guidelines for Good Practice. (2nd ed.), McGraw-Hill International (UK) Ltd., Maidenhead.

Ehikioya, B 2009, “Corporate governance structure and firm performance in developing economies: evidence from Nigeria”, Corporate Governance, vol. 9, no. 3, pp. 231-243.

Finkelstein, S & Aveni, R 1994, “CEO duality as a double-edged sword: How boards of directors balance entrenchment avoidance and unity of command”, Academy of Management Journal, vol 8, no. 4, pp. 1079-1108.

Flick, U 2009, An introduction to qualitative research (4th ed.), Sage Publications, Los Angeles.

Islam, M, Bhattacharjee, S & Islam, A 2009, “Agency Problem and the Role of Audit Committee: Implications for Corporate Sector in Bangladesh”, International Journal of Economics and Finance, vol. 2, no. 3, pp. 177.

Jha, N 2008, Research methodology, Abhishek Publications, Chandigarh.

Khanchel, I 2007, “Corporate governance: measurement and determinant analysis”, Managerial Auditing Journal, vol. 22, no. 8, pp. 740-760.

Laporta, R, Lopez, F, Shleifer, A, & Vishny, R 1999, “Investor protection and corporate valuation”, NBER Working Paper Series, vol. 7, no. 4, pp. 34-42.

Liamputtong, P 2009, Qualitative research methods (3rd ed.), Oxford University Press, South Melbourne.

Majumdar, S, & Chhibber, P 1999, “Capital structure and performance: Evidence from a transition economy on an aspect of corporate governance”, Public Choice, vol. 9, no. 8, pp. 287-305.

Marshall, C & Rossman, G 2011, Designing qualitative research (5th ed.), Sage, Los Angeles.

McBurney, D & White, T 2010, Research methods (8th ed.), Cengage Learning, Belmont, CA.

Northouse, P 2010, Leadership: theory and practice (5th ed.), Sage Publications, Thousand Oaks.

Rajagopalan, N & Zhang, Y 2009, Recurring failures in corporate governance: A global disease?. Business Horizons, vol. 52, no. 6, pp. 545.

Rashid, A, DeZoysa, A, Lodh, S & Rudkin, K 2010, “Board composition and firm performance: evidence from Bangladesh”, Australasian Accounting Business and Finance Journal, vol. 4, no. 1, pp. 76-95.

Sachdeva, J 2009, Business research methodology, Himalaya Pub. House, Mumbai.

Siagian, F, & Tresnaningsih, E 2011, “The impact of independent directors and independent audit committees on earnings quality reported by Indonesian firms”, Asian Review of Accounting, vol. 19, no. 3, pp. 192-207.

Sorensen, R 2007, “Does dispersed public ownership impair efficiency? The case of refuse collection in Norway”, Public administration, vol. 85, no. 4, pp. 1045-1058.

Treadwell, D 2006, “The role of the non-executive director: A personal view”, Corporate Governance, vol. 6, no. 1, pp. 64-68.

Vafeas, N & Theodorou, E 1998, “The relationship between board structure and firm performance in the UK”, The British Accounting Review, vol. 30, no. 4, pp. 383-407.

Weill, L 2003, “Banking efficiency in transition economies”, Economics of transition, vol.1, no. 3, pp. 569-592.

Yin, R 2009, Case study research: design and methods (4th ed.), Sage Publications, Los Angeles.

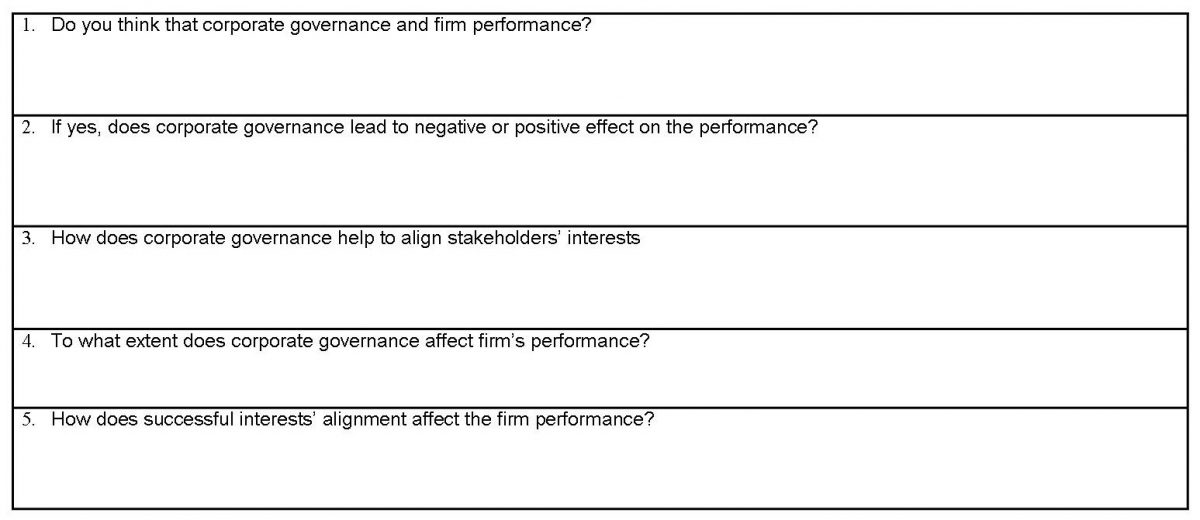

Appendix: Survey Questions